Trump inaugurates a new protectionist era with threats of even higher tariffs

The US president doubled levies on India before the new rates took effect on Thursday, with multiple uncertainties still waiting to be cleared up

U.S. President Donald Trump continues to hammer away at the coffin of globalization. The leader who often proclaims that tariffs are “the most beautiful word in the dictionary” has demonstrated in his six months in office that he has polished this term and intends to continue doing so for his remaining time in the White House. On Thursday, the new tariffs that Washington has imposed on most countries went into effect. But their implementation does not dispel uncertainties.

On Wednesday, Trump doubled the tariffs on India to 50% over its oil purchases from Russia. And the day before, he issued a new threat to the European Union. In an interview with CNBC, the Republican leader warned Brussels that U.S. tariffs could soar to 35% if the $600 billion investments that the EU pledged to make in its recent agreement do not materialize.

Trump also announced that he will impose a 100% tariff on imports of semiconductors and chips, but with one important exemption: it will not apply to companies that manufacture in the U.S. or commit to doing so. The measure is in line with the president’s goal of bringing manufacturing back to his country. This announcement coincides with the news that Apple will invest an additional $100 billion domestically.

Although Trump’s statements do not constitute a formal announcement, affected countries have reacted to the news. South Korea’s chief trade envoy welcomed the fact that chip manufacturers Samsung Electronics and SK Hynix will not be subject to the tariff. His country, he said, will have the most favorable tariffs for semiconductors under a trade agreement between Washington and Seoul. At the other end of the spectrum, the president of the Philippines semiconductor industry, Dan Lachica, said Trump’s plan would be “devastating” for his country.

The implementation of the new regime will impose 15% tariffs on most U.S. allies—including the EU—with some facing a minimum rate of 10% and others a maximum of 50%. At least for now. It is still possible, given Trump’s volatile temperament, that modifications will be introduced at any given time.

Sanctions on Russia

The first changes to the general tariff regime are, in fact, imminent. Trump, who has found in trade policy his favorite tool of pressure against partners and rivals, has already indicated that he could impose sanctions and tariffs on Russia, and secondary tariffs on other buyers of Moscow’s oil, as early as this Thursday or Friday. For next week, he has announced new 100% tariffs on semiconductors, and levies on pharmaceutical products. The latter could be taxed now with a fairly moderate rate, and in a couple of years with a shocking 250%, as the U.S. president warned in an interview earlier this week.

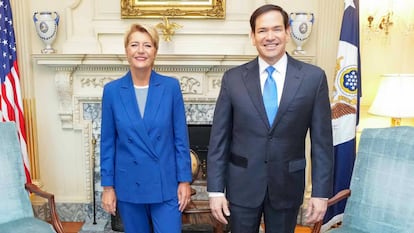

In Washington, Swiss President Karin Keller-Sutter met with Secretary of State Marco Rubio on Wednesday in a race-against-the-clock negotiation to achieve a reduction in tariffs on her country, currently set at 39%.

Another deadline will be reached next week: the one Washington and Beijing have set for resolving their respective tariff treatment, which expires in principle on Tuesday although both capitals have hinted at a possible extension. Mexico has more leeway, having negotiated a 90-day extension to reach an agreement.

Despite the enormous unanswered questions—the main one being what real impact this lurch toward protectionism, after decades of globalization, will ultimately have on the global economy, and on the U.S. economy—Trump is exultant about his policy, which he considers an absolute success. “We have a lot of money coming in—much more money than the country’s ever seen,” he has proclaimed.

The figures, for now, partially support him. In July, the U.S. Treasury collected around $30 billion in import taxes, 242% more than in the same month last year. Since April, that figure has surpassed $100 billion.

With that money, Trump hopes to finance the sweeping tax cuts he has implemented in the United States and reduce the country’s ballooning sovereign debt of $36 trillion (more than 120% of its gross domestic product). He has even flirted with the idea of distributing checks to the country’s citizens at some point in the future.

The question of inflation

The big question is what will happen with inflation, the major problem that ultimately cost his predecessor, Joe Biden, the presidency. For now it’s under control, largely because importing companies have absorbed the costs of the tariffs so far. But prices are beginning to show signs of rising, especially in sensitive sectors like toys and electronics.

That has always been the European criticism of Trump’s decisions: that tariffs are taxes that citizens end up paying. The logic is that, in the end, higher import taxes translate into higher final sales prices. However, that hasn’t deterred Trump or the MAGA universe that supports him. Within this conglomerate that supports the Republican leader, it is also believed that the U.S. bears a greater burden than other countries due to its contribution to security, very evident in the case of Europe, and because the dollar is the global currency, hurting American exports.

Security was a key issue at the negotiating table with the European Commission. Eastern European countries and Germany were keenly aware that, without U.S. protection, they would be much weaker vis-à-vis Russia. Added to this was the argument that, even if the agreement reached was deeply unbalanced, it would avoid a trade war, which would be worse, and would provide certainty for businesses.

But certainty is clearly not going to happen. That was one of the major warnings issued by analysts to the EU Commission and the Member States most impatient to reach an agreement, primarily Germany.

The strategy the EU intends to pursue now to cushion the impact of rising tariffs involves expanding trade alliances to diversify markets. The often-heard argument is that the U.S. accounts for only 13% of world trade and that more attention needs to be paid to the remaining 87%. And there have been some initial agreements reached in recent weeks, such as the one with Indonesia or the common goal set by Brussels and New Delhi of having a trade pact before the end of the year—a very ambitious objective considering that India has traditionally been markedly protectionist. The diversification plan also includes ratifying the agreements already concluded with Mercosur and Chile. And, finally, there are plans to deepen the single market itself, a long-standing dream of European technocracy.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.