What investor doesn’t want to find the next Apple? Experts offer clues on spotting the future stars of the stock market

EL PAÍS spoke to analysts of financial markets about how to anticipate the next wave of millionaires on the trading floor

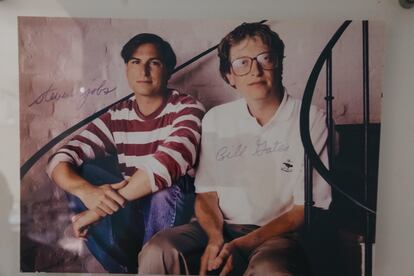

Stock market history shows that in the 1970s, the star stocks were those linked to basic resources such as oil and metals. From the 1970s to the 1980s, the baton was passed to stocks linked to home computing and personal electronics. The 1990s ushered in a new era of mobile communications and, as a result, telecoms and the media came to the fore. In the 2000s, it was the turn of the emerging markets and the rapid urbanization of China, meaning consumer and mining stocks took center stage. In the next decade, talk of digital disruption became fashionable and, with it, e-commerce and internet platforms. It is from 2020 onwards that healthcare innovation sectors, energy transition and, once again, digital disruption practically dictate how the stock market scenario will play out.

In all these years, especially since the beginning of the 21st century, there are stocks that have quite simply stood out. To the surprise of many, the shares that have appreciated the most during this time have been those of Monster, the energy drink manufacturer. They have risen by more than 100,000%: 1,000 shares in 2003 worth about $40 are now worth about $55,000. Amazon has not fared badly either: from one share worth almost $4.5 in early January 2000, they now trade at around $130. Netflix, Apple, Mastercard, Microsoft, Berkshire Hathaway, ExxonMobil, Tesla, Alphabet and, much more recently, Nvidia, are some of the other well-known stocks that have done much better than average. And there are other lesser known stocks that, in the last decade, have risen more than 1,000%, such as Plug Power, AXON, Ubiquiti and Old Dominion.

The question that arises from this data is both simple and complicated: can these success stories provide clues for the future? Steven Smith, Investment Director of equities at Capital Group, does not believe that history will repeat itself. In his view, the long-term trends in equities today are focused on healthcare innovation, with companies developing new drugs and new technology to combat cancer and obesity. The focus is also on digital disruption; apparently the next stimulus could come from the mass adoption and commercialization of artificial intelligence (AI). “It is likely that semiconductor manufacturers such as Broadcom, TSMC, and ASML will benefit from this impending wave of more intense digital disruption, as they will be the providers of the computational processing power for AI models,” Smith explains.

Going forward, efforts to decarbonize the global economy can, in his view, provide an additional boost over a number of decades to companies in a wide range of sectors. “This includes raw materials, semiconductors, electric vehicles, energy storage, electrification equipment and HVAC suppliers, as well as suppliers of alternative fuels such as clean hydrogen,” he says. Finally, he is convinced that changes in globalization, such as increased offshoring, “can create opportunities in a number of sectors, such as logistics, infrastructure machinery and medical equipment.”

Separating the wheat from the chaff

According to Pierre Debru, Head of Quantitative Research & Multi Asset Solutions at WisdomTree, not every AI or battery company will become the next Apple. Some companies will fail, some will stagnate, and a few will become tomorrow’s leaders. As he explains, “it’s all about the ‘winner-take-all’ effect, which means only 4% of all U.S. companies have accounted for all the wealth creation in the U.S. stock market since the 1920s.”

For Luis Artero, head of investments at J.P. Morgan Private Banking in Spain, history is still “a useful guide,” especially if we examine the period prior to the global financial crisis. In his view, the 21st century investment landscape was characterized by ultra-loose monetary policy, as inflation in the developed world was particularly low. “While we believe those days are over, we also believe that quality fixed income should be considered to protect portfolios from downside risks, as should investing in real assets, which have historically proven their worth in periods of high inflation,” he says.

In his view, we are probably facing a new technological transition, namely that of AI, which over time “can be a driver of productivity, which could in turn modestly boost GDP growth in the developed world and so provide tailwinds for corporate profits in general.”

According to Jamie Mills O’Brien, Investment Director of Aberdeen Standard Investments, the answer to this question is complex. He explains that “we are witnessing a period in which it is the big companies, the internet monopolies, that are driving innovation in many areas. The heavy reliance of generative AI on data and advanced processing gives an advantage to those companies with the breadth, engineering capability and capital to design the silicon and harness the data needed to run it at scale.”

Mills O’Brien questions whether we are facing a paradigm shift in the markets and need to look for new leaders. “If you look at Nvidia’s revenue in data centers, the answer is a resounding yes,” he concludes. He also adds that any strategy that relies simply on buying and holding onto the biggest companies is likely to render poor results. In his view, “some of those companies will thrive, although they are likely to be few and far between. I suspect that the scarcest skill will be the ability to access and invest in those smaller and equally scarce companies, slightly removed from the mainstream, that are able to leverage this technology to scale and drive profits,” he says. “These will be smaller, future-leading companies in areas such as artificial intelligence, healthcare, and green technologies.”

When it comes to choosing the best guarantee for the future, everyone is putting their money on the stock markets, an area in which history has provided the key data. Stefan Rondorf, Senior Investment Strategist, Global Economics & Strategy, Global Economics & Strategy at Allianz Global Investors, turns to the data again by pointing out that if you look at broad data series, you will see that from 1801 to the end of 2022, US government bonds have shown an average return of 3.3%, while the return on U.S. equities has been 6.88%. The difference lies in the risk premium of 2.84%. “Anyone who invested a dollar in bonds at the beginning of the series would have pocketed just over $1,300; if they had invested it in stocks, they would have taken home more than $2.4 million,” he says.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.