The chip kings: Technology companies that make the world go round

Taiwan’s TSMC, South Korea’s Samsung and U.S.-based Nvidia are leaders in a strategic sector where commercial and geopolitical interests overlap

Without chips, washing machines would not spin, cars would not start, drones would not fly, and cell phones, computers and game consoles, among a myriad of other devices, would not even turn on. Chips are everywhere, but most of the companies behind them are unknown to us, unlike famous tech firms such as Facebook, Amazon, Apple and Google. The entrails of these devices are a microscopic and ever-changing universe where competition revolves around nanometers smaller than a virus — and the smaller they are, the more advanced.

For decades, the West has had them manufactured in Asia, taking advantage of the efficiency of globalization’s supply chains to buy them cheaply. But the pandemic, with its factory closures and bottlenecks, plus the growing geopolitical tensions in sector leader Taiwan, have meant a shift in approach: however expensive it may be, Europe and the U.S. want to reduce their dependence on Asia and bring at least part of the production process home. These are some of the companies that dominate semiconductors, and which will receive much of the government subsidies aimed at recovering autonomy in this strategic area both in civil and military terms.

TSMC, the Taiwanese giant

The Taiwan Semiconductor Manufacturing Company, known by its acronym TSMC, manufactures most of the advanced chips used in the world today, and boasts around 56% of the global market share. It is worth $537.7 billion on the stock market, making it the 10th largest listed company on the planet. Its founder, Morris Chang, was educated at Harvard, MIT and Stanford, all elite American universities. Chang has turned Taiwan into the epicenter of an ecosystem unparalleled in other parts of the world, partly because his government had the vision to support it with substantial tax breaks before it became clear how important these chips were going to be. Cutting-edge chip technology consequently became something of a national project for Taiwan which took off in the 1990s.

Neither China nor the U.S. have been able to match the sophistication of TSMC’s plants. So much so that in his recent book Chip War, U.S. historian Chris Miller warns that a single Chinese missile against TSMC’s most advanced factory “could easily cause losses of hundreds of billions of dollars” from delays in the production of phones, data centers, automobiles and telecommunications networks. But the firm’s expansion outside Taiwan is underway. TSMC is building a factory in Phoenix, Arizona, into which it will pour $39.8 billion, one of the largest investments in U.S. history. The idea is to produce three and four-nanometer microprocessors for Apple’s iPhones, one of its main customers. It is also considering opening another plant in the German region of Saxony, with an estimated investment of $10.7 billion.

Samsung, much more than just phones

Known for being one of Apple’s great rivals in the smartphone war, Samsung is also among the largest chipmakers on the planet, with a 17% market share. And the South Korean firm wants more. It has an ambitious long-term plan to join forces with its government and invest more than $215 over the next 20 years with the aim of triggering a qualitative leap for its semiconductor industry.

South Korean President Yoon Suk-yeol is aware that there is intense competition, not only for semiconductors, but also for the electric car, batteries, new green fuels and digitalization and the ecological transition in general, so he has not hesitated to support the country’s flagship company. “The economic battle, which began recently with chips, has expanded,” he said in March. “Governments are providing subsidies and fiscal support on a large scale.” With a market value of about $354.9 billion, Samsung ranks 21st in the global ranking of listed companies.

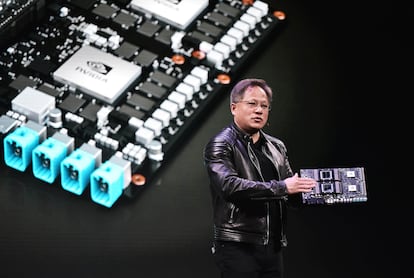

Nvidia: the power of artificial intelligence

No company in the sector is experiencing a sweeter 2023 than the American company Nvidia. The boom in artificial intelligence (AI), with applications such as ChatGPT using its chips, has boosted the results of this company, founded 30 years ago. It now belongs to the exclusive club of those valued at more than a billion dollars, rubbing shoulders with Apple, Microsoft, the Saudi oil company Saudi Aramco, Alphabet and Amazon. The first arresting thing about about the firm is its name. The three founders gave it the working title, NV, standing for Next Version. But they wanted something different in the end, so they looked for words beginning with the letters nv and found the Latin word invidia meaning envy, from which they removed the first letter.

Proving to be the envy of the stockmarket, Nvidia’s share price has appreciated by more than 170% so far this year, pushing it into sixth place among the world’s listed companies. Its $11 billion revenue forecast for the second quarter of 2023 shattered the $7.15 billion ceiling of Wall Street analysts’ forecasts. And if the future of AI is as rosy as the experts predict, its growth potential is still enormous, which might make it the world’s leading company one day.

ASML: the European success story

Europe manufactures only 8% of the world’s chips, even though the continent consumes 20%. But in the labyrinthine chip supply chain, there is room for spin-off tasks, from design to encapsulation. In the complex distribution system of these tasks, which involves continuous country hopping, there is one company without which the industry would find it very difficult to operate. It called ASML — an acronym for Advanced Semiconductor Materials Lithography — and it is Dutch. Its plants produce almost all the extreme ultraviolet lithography machines used to print transistors almost as small as the diameter of a human chromosome on sheets of silicon. Without them, the most recent generation of chips would be impossible to manufacture. You could say they make these for the manufacturers. And it pays off: ASML is the second largest European company with a stock market value of $290 billion, trailing only the French luxury conglomerate LVMH, and far ahead of Spain’s Inditex.

ASML’s importance has placed it in an awkward position geopolitically. The U.S. has not only imposed restrictions on U.S. chip companies’ exports to China to prevent the Asian giant from gaining access to cutting-edge technology, it has also pressured partner countries such as Japan and the Netherlands to do likewise, with ASML caught in the firing line. The firm derives 15% of its revenues from shipments to China, so it remains to be seen how the Dutch government’s subsequent export restrictions on “state-of-the-art” semiconductor technology will affect its results.

The crossfire between the global powers has had other impacts on ASML, some of them what you might expect from a spy movie. Last February, it reported that one of its employees in China stole information regarding its technology, raising concerns about how to preserve intellectual property in a volatile environment. In an interview with The Financial Times three months ago, the companys boss, Peter Wennink, compared the semiconductor era to the 1973 oil crisis. “Oil was always there until it wasn’t, and it was a strategic commodity,” he said. “Fast forward to 2020 and it’s the same thing with chips.”

Intel: a Silicon Valley pioneer in the doldrums

It is often said that Intel was the company that brought the silicon to Silicon Valley, as it was the material from which chips are made. The company is probably the best known among today’s players, but also the one that has had the bumpiest ride. On its website is the story of how it started up: Gordon Moore dropped by Bob Noyce’s house while he was mowing the lawn and had a casual conversation, and Intel was born out of that, in July 1968. Moore’s famous law, which states that the number of transistors on a microchip doubles every two years along with its computing power, while its price falls, dates back to that time.

Intel was at the cutting edge of innovation during its first decades, but in the last 10 years it has been slowing down: it went from leading the computer market with its processors to lagging behind as it remained outside the cell phone market. Consequently, it has been losing ground and has been overtaken by a new wave of Silicon Valley wizards.

On February 15, Pat Gelsinger took over as the new CEO to halt the company’s seemingly inevitable decline. The announcements were grandiose: multi-million dollar investments — close to $21.5 billion — to build two chip factories in central Ohio. And the environment was very favorable, with Joe Biden’s government launching a $268.8 billion investment plan to gain autonomy in the strategic semiconductor sector. However, the firm that once led the technological revolution is still perceived as slow to adapt to changes: it has not jumped on the AI chip bandwagon, and Apple announced days ago that it will definitively stop using its processors and manufacture them itself, leaving a significant hole in its accounts.

Its stock market value, $129 billion, is eight times lower than that of Nvidia, despite exceeding it five years ago. And its expansion into Germany is up in the air after it asked for more public money in exchange for building its factory in Magdeburg. Spanish Prime Minister Pedro Sanchez is among those who have courted Gelsinger, specifically at last year’s Davos Forum, but there is still no news of investment from these companies in Spain, which has $13 in subsidies available for whoever takes the plunge.

Micron: the victim of the Chinese veto

Micron is not among the dominant companies in the sector, although its size, $77 billion in stock market value, is by no means negligible. Due to the fact that China’s cyberspace regulator announced on May 22 that Micron had failed its security tests and that it was banning key infrastructure operators in China from buying its products, it has been much in the news. Micron’s sales to China account for 11% of its revenue, and Beijing’s action is a way of saying that it does not want so many U.S. chips. The duel between the two major powers has thus been transferred once again to the corporate world, triggering uncertainty both in Chinese companies with interests in the U.S., such as TikTok and Huawei, and vice versa.

SMIC: China’s great hope

China’s main asset for developing its own ecosystem is called Semiconductor Manufacturing International Corporation (SMIC). The company is in the crosshairs of Washington, which in 2020 limited exports of advanced semiconductor manufacturing tools to the company after concluding that there is an “unacceptable risk” that its products could be used for military purposes. In other words, it fears that SMIC’s chips could end up in weapons used in a future invasion of Taiwan, for example. Consequently, it does not want Western companies to contribute in any way to supplying it with technology. That leaves SMIC in a difficult position. As soon as the veto was announced, its shares fell, but they have since recovered and are now worth around $32 billion, some way behind its competitors.

AMD and Qualcomm

An indication of the sector’s strength is the density of large companies operating in it. AMD, worth almost $215 billion on the stock market, and Qualcomm — $132 billion — are among the leading names. Their trajectories, however, are far from similar. The former has staged one of the greatest recoveries in corporate America by going from borderline bankruptcy and being worth 60 times less than Intel a decade ago to generating some of the most widely used chips, surpassing Intel and revaluing nearly 5,000% on Wall Street under the leadership of Taiwanese-born executive Lisa Su, who has been its CEO since 2014. Meanwhile, Qualcomm, which, as one of its main suppliers, is often associated with Apple, is experiencing a period of uncertainty in the face of the possibility that Apple will begin to manufacture the 5G chips it needs for the iPhones it launches in 2024 all by itself.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.