‘When are you getting the Lamborghini?’ This is how the NFT market is surviving after promising millions to its investors

The technology that allows for the creation of unique works gave an enormous boost to digital art. Nowadays, however, NFTs are dealing with malaise and waiting for better times

In March 2021, a digital painting by an artist called Beeple was auctioned at Christie’s for more than $60 million. Beeple posted a video watching the auction in real time from the living room of his home in South Carolina. “It’s an absolutely ridiculous amount,” he noted, when the bidding reached $14 million. By the end of the auction, he threw up his hands and shouted with joy. “I think this shows that digital art is here to stay,” he laughed.

But things haven’t exactly worked out like this.

That sale was Christie’s first auction of an NFT. An NFT — a “non-fungible token” — is a technology that allows us to establish who is the sole owner of a digital artwork. It’s a model based on blockchain: different servers maintain the same chain of data, preventing it from being modified. Thus, an NFT is an everlasting signature that links a work to an owner. It’s recorded on computers in various places around the world.

The auction of Beeple’s work was also the beginning of a unique (and short-lived) period of enthusiasm for NFTs. They became so popular that they actually created a sense of scarcity in the digital art sector. “I knew almost nothing about NFTs until four months before the big sale at Christie’s,” Beeple stated in an interview. “But I also saw that this wasn’t a new moment. There were other [times] when something wasn’t considered art… and then, suddenly, it was.”

And what’s the difference between being art and not being art? Scarcity, or the ability to collect. NFTs came to fill that gap. And, when there’s scarcity, capital sees an investment opportunity with the possibility of high returns.

NFT MARKET pic.twitter.com/jKFL9Td02L

— beeple (@beeple) August 23, 2023

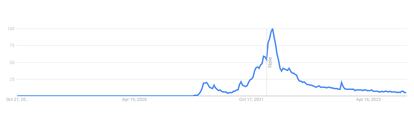

That milestone made “NFT” become a commonly-used word. And it created a sense of debauchery, which subsequently led to a bubble. Today, NFTs have disappeared from the headlines. However, in various corners of the internet, there are people confidently awaiting their return. Even more so on days like this past Tuesday, when the price of Bitcoin hit $32,000 — a value that hadn’t been reached for more than a year.

In August, Beeple tweeted a photo describing the burst bubble. It’s titled “NFT Market,” with an image of a mountain of yellow Lamborghinis in the scrapyard. The reference to Lambos is a recurring joke in this digital world. “The bear market has eliminated a lot of harmful projects,” explains digital artist Sohobiit. Like others interviewed for this article, she prefers to identify herself publicly only by her well-known digital nickname. “When I entered [the NFT market] in 2020, there were projects that had multi-year roadmaps… but there were some that couldn’t have been completed in 40 lifetimes.”

Hence, the question on everyone’s lips — “When are you getting the Lamborghini?” — was almost always left unanswered. Lambos were the pinnacle of that brief era. Few got their hands on one.

Apart from the most harmful projects, other legitimate ones also teetered dangerously. “Many NFT projects have had to abandon their dreams, because we (the NFT traders) need to eat. There’s hope that things will get better, but we can’t just make a living from a hobby,” Sohobiit sighs. As with all types of speculation, there are those who made a profit, those who broke even, and those who lost money. A new study confirms that the majority of NFTs have lost almost all their value: 69,795 of 73,257 NFT collections have a capitalization of 0 Ether (Ethereum being the most-used cryptocurrency for NFTs), leaving 95% of those who own collections of NFTs with worthless investments.

Another emblematic example is the NFT of the first tweet of Jack Dorsey, who then ran Twitter (now X). In March 2021, the tweet — along with Beeple’s work — was a major example of the arrival of NFTs. Dorsey sold it for almost $3 million. A year later, its owner wanted to resell it, but nobody wanted it. Today, the best offer it can get is around $1,300. Clearly, no investor is willing to pay millions for that first tweet. Of course, there’s some nuance to this story: the owner — crypto entrepreneur Sina Estavi — has chosen not to sell for the moment, given that we’re in a bear market. The most valuable NFTs have lost a lot of value, but that doesn’t mean that they won’t be lucrative in the future.

Undoubtedly, however, there’s a big slowdown. And the future is difficult to predict. “Empirically, the number of transactions has been decreasing,” says professor Carlos Baquero, from the University of Porto (Portugal). “I think there were two types of markets. The most prominent was focused on collections and profile pictures — owning these NFTs implied status and granted [owners] access to some communities. There was probably a lot of speculation — as well as high expectations — around these assets. Then, there was a second market, a much smaller market, focused on single-edition pieces. In this case, some of the buyers probably bought for esthetic reasons, but there were also expectations of an increase in value. And the values were highly inflated,” he notes.

A good example is the first major Hispanic NFT project, from a YouTuber named WillyRex. The most coveted single piece from that collection sold for around $15,000. Its owner — a Latin American businessman who identifies himself as Santiago on his X account — has no intention of selling. “I have the most important [NFT] of all, the only copy that exists. I’ll keep it forever. The value that other people believe it has doesn’t matter to me,” he tells EL PAÍS.

Beeple sold a piece of digital art for $69M, helped kick off the bullrun and played a pivotal role in bringing this new blockchain medium mainstream…and people berated him for offramping

— funghibull (@funghibull) October 1, 2023

Unbothered and entirely in his own lane, Beeple took that momentum and partnered with his… pic.twitter.com/IyeGZVDxja

“If I had had enough money I would have bought it,” sighs Valentí Gàmez, a 30-year-old Spanish software developer, who owns other, much cheaper pieces from the WillyRex collection. “It’s like having a painting in your house that’s by an artist you like. For me, it’s very similar on a digital level. NFTs allow you to identify who’s the owner of that painting. And I can sell it at any time,” he adds.

Today, X is full of people joking about NFTs. What once seemed like an irresistible investment has become (for now) a bunch of pixels being given away. But there’s always the chance that the bear market may change. If a bull market were to arise, perhaps new NFTs could end up selling for a lot of money. “I’m not sure if there’ll be expensive NFTs again when [cryptocurrencies] like Bitcoin and Ethereum go up,” says Gàmez. “I don’t have a crystal ball. The only thing I do know is that the technology that allows for digital property [will remain as such]. And there are many companies that are committed to [NFTs] and willing to invest in creating related products,” he affirms, referring to video game companies or clothing brands.

Gàmez has created a Discord server (a messaging app similar to Slack) for all confirmed WillyRex NFT buyers. WillyRex himself even joined. This server is now an example of the original idea of NFTs, which was to have extra benefits accompany your purchase. The most famous NFT collections in 2021 were the CryptoPunks and the Bored Apes (their prices haven’t fallen that much), which are types of clubs where everyone — from hackers to the rich and famous — meet via digital avatars.

Users like Gàmez — who believe in technology and have invested carefully according to their criteria — aren’t suffering financially in a declining market, as they didn’t use all their money on NFTs. But along with notable projects, there were others that have grown without meaning. “I’ve followed projects that opted for technology to build a serious model. And others that have opted to create a community of day-trading, of investment, of trying to get a Lamborghini. There are people who’ve promised things that they haven’t fulfilled,” Gàmez emphasizes.

The fear of bubbles bursting weighs on buyers and sellers alike, as they wonder if they’re being left out of a unique investment. In Spain, for example, Sons of Bitcoin raised more than $30,000 to become an “NFT community oriented towards the creation of events/hangouts/activities.” But after the money was raised, nothing happened. “They haven’t published anything for six months. They were saying that they were going to start a clothing or merchandising brand… and now they say that they don’t want to advertise it,” laments AlbertNFT. “I lost [money] from buying into this NFT,” he complained on Discord, referring to his bad experience with Sons of Bitcoin.

buying an NFT in 2023 pic.twitter.com/CGE8LmKadw

— beeple (@beeple) August 21, 2023

That feeling of community is important to David Mancebo, who’s in a Discord channel with WillyRex after having paid $25 for a digital piece from one of his NFT series. “During the first few months I was offered [$500-$600], but I didn’t sell it,” he explains. “[Having the piece] gives me access to a Discord channel (the same one that Gàmez and Santiago are in) where WillyRex is active. If it never ends up taking off, then at least having been in the group will have been cool,” he shrugs.

For this same reason, a user who goes by the name NFtOasis — a 28-year-old from the Canary Islands (Spain) — also remains attentive: “We’re seeing a cleanup within the NFT market. [In the past], collections came out every day and they contributed nothing. Now, though, collections have come out which not only offer beautiful images, but they also have real utility. As the owner of the collection, you get benefits. It’s because of these collections that I choose to hold on to my NFTs,” he explains. That “real utility” is that the NFT is linked to benefits such as product subscriptions, membership in communities, as well as the option to attend events in the real world.

Will NFTs make a comeback?

The most widespread belief is that the return of NFTs will depend, in part, on Bitcoin and Ethereum rising again. “This happens in spurts. If Bitcoin goes back to $32,000, well, you’ll see all the people [going for NFTs] again… and if it goes down to $20,000, you won’t. That’s the story,” AlbertNFT summarizes. However, while cryptocurrencies are gaining in value, it remains to be seen if the NFTs will follow the trend. At the moment, the clearly bullish cycle is oriented towards artificial intelligence. “A lot of people have switched [from NFTs and crypto] to AI. That’s the trend, the fashion. Yesterday, they were talking about Bitcoin. Today, it’s all about AI. We have to take advantage of it,” he adds.

A second reason why NFTs could become popular again has to do with ease of use. The purchase of crypto — the ownership of a digital wallet and the intricate transactions required — are still far from the knowledge of the average user: “Until now, it was a pain for users,” Gàmez acknowledges. “But now, there are starting to be easier ways to [deal with NFTs]. Sometimes, you don’t need a wallet — your email and password is enough. A year ago, this was unthinkable. You almost had to be a hacker.”

The variety of uses that an NFT can have also works in its favor. “The NFT market is undergoing a correction,” points out Hongzhou Chen, a researcher at the Chinese University of Hong Kong. “It’s essential to consider the transformative potential of this technology in decentralized and centralized models. Due to the uncertainty of today’s world, decentralized systems could have enormous potential amid the cracks of great powers. It’s too early to predict the end of this type of technology,” he cautions.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.