Stock market exodus to Wall Street hits 20-year high

The U.S. exchange has become the go-to destination for foreign firms aiming to go public. About 50 European companies have listed there this year

The U.S. exchange has become the go-to destination for foreign firms aiming to go public. About 50 European companies have listed there this year

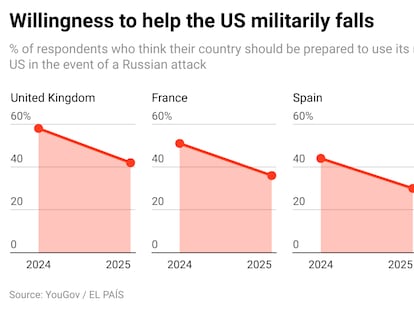

The Republican’s return to the White House has destabilized markets and diplomatic relations

Investing in the US stock market has yielded significant long-term returns, but these gains are considerably diminished if the investor sells in a panic or in haste

The turbulent politics of the White House are setting the stage for instability, fueled by the spread of questionable information on social media

The 25% levy on steel, aluminum, and cars remain in place, as does the 10% universal rate on most imports

The blow to public debt was the final straw, following the market crash, internal criticism, and warnings from investors and business leaders

European markets rise nearly 2.5% after sharp declines, while US indices falter following a 104% tariff announcement on the Asian country

Global markets are facing their worst days since the pandemic, with Trump’s harsher-than-expected trade war stoking fears of a recession, triggering panic among investors, and causing an economic earthquake

Wall Street slides nearly 10% in two days and drags down all the world’s stock markets. Experts say the key lies in whether the levies are ideological or a bargaining chip

The S&P 500 plummets nearly 4% in its worst day in two years. The euro surges above $1.11, and Brent crude oil sees a sharp decline of 7%

The stock market experienced a sharp fall as Washington’s protectionist threat against its trading partners was fulfilled

The nation’s economy is steady but with some signs of weakness, as investors grow more skeptical of the S&P 500 rally. White House policies will tip the balance toward either more growth or more of a slowdown

Big investors are enjoying a stock market at an all-time high, driven by the tycoon’s victory. However, they are beginning to become suspicious of his costly proposals, which would drive up inflation and harm the millions of retail investors who voted for him

Edward Leffler created the first open-end mutual fund, democratizing investment by offering small-scale savers a low-cost financial product managed by professionals. His original fund has achieved an annual return of nearly 9.5% over the last century

Despite the high valuations, the U.S. stock market is still acting as a magnet for investors seeking opportunities (and often ignoring the risks)

The announced levies of up to 25% on imported goods accelerates early imports and increases the volume of shipments from the Asian country

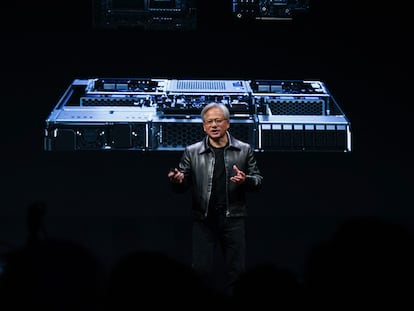

At the close of trading on November 20, the chip maker will release its much-anticipated third-quarter report. Despite setbacks with its GPUs and Blackwell chips, the tech giant is expected to perform strongly

According to experts, valuations of tech companies, interest rate developments and corporate earnings are overshadowing political risks on investors’ list of concerns

The former head of global strategy for JPMorgan had been warning of a correction since September last year. He was fired a few days before the S&P 500 plunged

Wall Street opened higher on Monday, following the failed assassination attempt against the Republican candidate. The private prison sector performed particularly well in the stock markets

Analysts are expecting slower earnings growth for Apple, Nvidia, Microsoft, Amazon and Meta

European share prices started the year on a positive note, trading at lower valuations, but analysts caution against confirming a trend shift

The company has promised analysts and investors strong business growth and profitability over the next three years

Wall Street’s rally got going with hopes that cooling inflation would get the Federal Reserve to dial down the pressure by cutting interest rates

Supervisors like the SEC and the ESMA are warning about misleading information regarding companies’ tech capabilities, and working to ensure artificial intelligence does not create a systemic risk for investors down the line

The AI chip leader closed the year as the best-performing stock on the S&P 500 index, with a revaluation of more than 200%

August tends to be a serene month in the financial markets, but when there is a crisis things can get chaotic