The secrets of Nvidia, a company sweeping the stock market on the back of artificial intelligence

The AI chip leader closed the year as the best-performing stock on the S&P 500 index, with a revaluation of more than 200%

On the morning of Tuesday, May 30, 2023, a technology company called Nvidia became the tenth in history to surpass a trillion dollars in stock market valuation. The achievement — as in other technology success stories — was surprising for its speed.

Investors — who sniff out trends and the most profitable business ventures — have followed the trail of artificial intelligence (AI) like no other this year. And in this sector, all roads lead to Nvidia. The big economic changes that AI promises have raised the company’s high expectations on the S&P 500 index. It’s been the best-performing stock of 2023, with a revaluation of more than 200%… very lucrative for those who were able to anticipate its rise.

With this massive leap in stock market valuation, Nvidia is now among the largest corporations on the planet. It currently occupies sixth place among listed companies, only surpassed by Apple, Microsoft, Saudi Aramco, Alphabet (Google) and Amazon. It’s ranked above Mark Zuckerberg’s Meta Platforms or Warren Buffett’s Berkshire Hathaway.

Of all these companies, Nvidia is definitely the one that is most unknown to the general public. The reason for this is that its star products travel in the guts of devices. Customer interaction is less visible than with Apple’s iPhone, Google’s search engine, or Amazon’s website. No one sees the tiny high-tech semiconductors created by Nvidia, used to train the AI systems that subsequently power applications such as ChatGPT. The graphic cards for video games or the high-performance computing systems are also invisible to the naked eye. Average consumers aren’t able to interact with the software that Nvidia uses to teach self-driving cars, which allows the vehicles to process large volumes of sensor data and make decisions in real-time.

In a sector as competitive as that of computer chips, where leading companies such as Intel or AMD have been operating for decades, what’s made Nvidia stand out from the rest in such a pronounced way? American historian Chris Miller — the author of Chip War: The Fight for the World’s Most Critical Technology (2022) — responds to this question by email, offering EL PAÍS an X-ray of how this industry has evolved: “Nvidia realized before anyone else that GPU chips (semiconductors that were initially designed for graphics processing) would also be very suitable for training artificial intelligence systems. More than 15 years ago, Nvidia began building a specialized software ecosystem around its GPU semiconductors, to allow companies to efficiently train them on artificial intelligence systems. This has been key to its ability to become the dominant player in AI training today.”

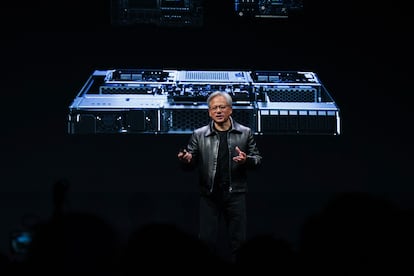

That is to say, the origin of today’s success wasn’t a miracle that occurred overnight. It began to take shape a decade-and-a-half ago. The firm — which gets its curious name from the Latin word invidia (envy) — is an example of stability at the top. Its founder — Taiwanese citizen Jen-Hsun Huang, an electrical engineer trained at Oregon State University and Stanford University — has been CEO for 30 years.

With so many disruptive possibilities attributed to the technological change that is AI, the money tends to go to the leading companies in the field. Nvidia has no competition for now… although this exaggerated dominance may be questioned soon, as Miller warns. “It has an estimated 90% market share in AI training, but other companies will try to produce competitive GPUs. AMD and Intel, for example, are investing heavily in this market. Additionally, cloud computing companies — such as Google, Amazon and Microsoft — are building their own specialized chips for internal AI training, which will also compete with Nvidia.”

It’s the law of the market. When Nike launched its revolutionary running shoes — each with a carbon-infused nylon plate — the rest of the brands didn’t take long to make their own versions. Now, the same thing is happening again, although the difference is that the level of Nvidia’s sophistication is greater than a shoe, meaning that there are no guarantees that its competitors will be able to imitate them. “Nvidia has been ousting rivals in a way that was seen as impossible years ago,” affirms Mateo Valero, professor of Computer Architecture and Technology at the Technical University of Catalonia. He’s also the director of the Barcelona Supercomputing Center. According to Valero, each of the new self-driving cars has one or two of the most powerful chips installed, each of which can cost around $30,000. They’re produced by Nvidia.

The technological dependence on a single company is a notorious phenomenon. It’s also Nvidia’s greatest strength. “Neural networks need a lot of high-speed chips and competitors have been left behind. Intel failed in the race eight or 10 years ago, [while] AMD started late. Most accelerators for supercomputers come from Nvidia. And now, it has a privileged position in both software and hardware. If Nvidia said: ‘Hey, we’re not going to sell Europe any more chips,’ we wouldn’t even be able to use AI.”

There are investors who have sold off their positions in Nvidia, thinking that, given its astronomical price, the normal occurrence would be for it to begin to lose market share. But Gonzalo León — professor emeritus at the Technical University of Madrid — points out that the company isn’t resting on its laurels. “The emergence of generative AI and the need to train large language models (LLMs) have dramatically increased demand. [In the past, Nvidia] had the right chip to respond: the H100. Now, they have announced the H200 for the beginning of 2024, with performance that’s double that of the previous one. It’ll be a new success.”

AMD has already responded to the challenge. Last week, the rival company launched a new chip — the MI300X — which they classify as the most advanced on the market for AI purposes. It’s AMD’s best bet to get a piece of the pie… the pie being the AI processor market, which the company estimates will be worth $400 billion by 2027.

Next year, investors will judge whether Nvidia still has the fuel to continue growing. Nobody knows whether it will get closer to the position of becoming the most valuable company in the world — a feat that’s no longer so far away — or, on the contrary, if the expectations surrounding AI will turn out to be exaggerated.

Of course, the final outcome doesn’t just depend on Nvidia: it’s also contingent on what comes out of its competitors’ laboratories.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.