Lagarde was a director of two Baker & McKenzie affiliates in tax havens

The current president of the European Central Bank was on the board of subsidiaries of the legal firm in Bermuda and Singapore between 2003 and 2005

Between 2003 and 2005, the current president of the European Central Bank (ECB), Christine Lagarde, was a director of a company that belonged to the law firm Baker & McKenzie, and that was registered in Bermuda, a small territory in the Atlantic off the coast of the United States that at that time was on the European Union’s blacklist of tax havens. Lagarde was also on the board of a company linked to the same international firm in Singapore, a country that was shielded by banking secrecy laws at the time.

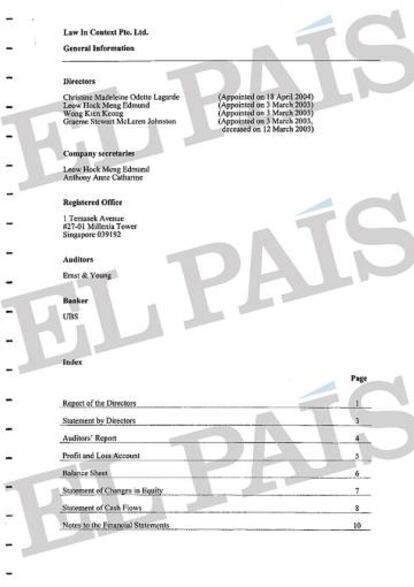

Until June 2005, Lagarde was a partner at the international law firm Baker & McKenzie. In Bermuda, this firm controlled Law in Context Ltd, a holding company where she was listed as a director, sources close to the law firm have confirmed to EL PAÍS. Lagarde left the holding company that year to become the foreign trade minister in the government of the French prime minister at the time, Dominique de Villepin. Years later, in 2011, she went on to become the managing director of the International Monetary Fund (IMF), and she is currently at the helm of the ECB.

Bermuda was on the EU’s tax haven black list for its low taxation regime until last May

Considered one of the most opaque places in the world, Bermuda was on the EU’s tax haven black list for its low taxation regime until last May. Google used the islands in 2017 to shift €20 billion from its Dutch subsidiary, Google Netherlands Holdings BV. The goal: to pay less tax in a legal way outside the United States via a legal ploy known as the “Dutch Sandwich.” Many multinationals use tax havens to reduce their tax bill. This practice is one of the major concerns of international organizations, who are seeking to put a stop to it.

The holding that Lagarde headed was registered at 41, Cedar Avenue in Hamilton, the capital of Bermuda. Other offshore companies are also based at this address, this newspaper has found.

Law in Context Ltd was created by Appleby, a law firm specializing in building offshore structures. With more than 200 lawyers, Appleby has subsidiaries in the Cayman Islands, the British Virgin Islands, Jersey, Guernsey, Mauritius, and the Isle of Man.

A spokesperson for Baker & McKenzie confirmed that “the holding [that Lagarde was a part of] was created under the corporate laws of Bermuda, then a common practice of many publicly traded companies that did business in a number of international countries.” In Spain, for example, many companies from the blue chip Ibex 35 index have affiliates in these territories where they do legal business.

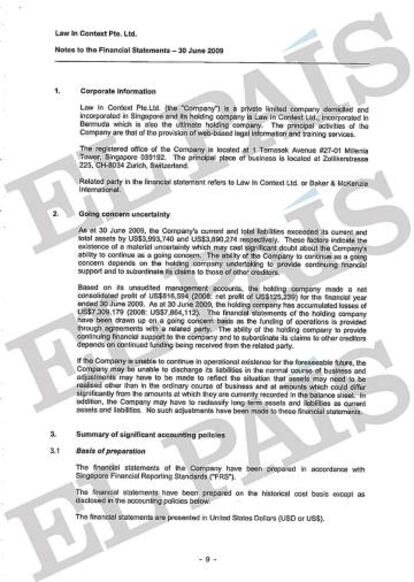

But the course of Law in Context Ltd did not go as expected. The company was faced with financial difficulties and did not get listed on the stock exchange, according to Ernst & Young.

“Lagarde had no economic interest in the activity of Law in Context Ltd beyond the minimal amount that any other Baker & McKenzie partner might have had. In any case, she lost this minimum interest when she left the firm to accept a role in the French government,” indicated sources close to the ECB president. “Largarde never had an account in a tax haven or benefited from any illegal advantage,” added these sources.

Created to share legal information via the internet, the company focused its business activities in Switzerland

After being admitted to the Paris Bar Association, Lagarde joined the prestigious Baker & McKenzie law firm as an associate in 1981, where she specialized in labor law, anti-trust issues, and mergers and acquisitions. She chaired the global executive and strategic committees in 1999 and 2004, respectively.

Sources familiar with the international law firm indicate that Baker & McKenzie had 500 associates when Lagarde worked for the company, and that the presence of the BCE president in the business structure of Law in Context was “marginal.” “This was a holding company that never received any income,” they added.

Law in Context Ltd was created by Appleby, a law firm specializing in building offshore structures

Baker & McKenzie created Law in Context Pte Ltd in 2003 in Singapore, a country then protected by banking secrecy laws that ranks eighth on the list of 64 tax havens from the Tax Justice Network. The firm was registered at 1, Temasek Avenue.

Created to share legal information via the internet, the company focused its business activities in Switzerland, according to a 2009 audit by Ernst & Young. The holding also had a subsidiary in the US state of Delaware that did business on US territory, according to sources close to Baker & McKenzie.

The law firm declined to detail the complete business structure of the company whose top management team Lagarde belonged to. It said that Law in Context Ltd provided online legal information to clients, and was created after the dot-com bubble, a period of growth for internet-based companies that occurred between 1997 and 2001. The service distributed information on laws and regulations in different countries, especially in areas such as private banking, compliance and labor issues. It also offered online training and anti-corruption regulation courses to clients, most of whom were multinationals, with some listed on the New York Stock Exchange.

Other partners at Baker & McKenzie, as well as Lagarde, were also listed as directors of Law in Context Ltd during this period. One of them was a Spaniard who was a member of the global executive committee and has since left the firm. In 2016, Law in Context Ltd was among the thousands of companies with ties to offshore territories named in the Panama Papers, a leak of 2.6 terabytes of opaque accounts managed by the firm Mossack Fonseca in the Central American country.

Bermuda and Singapore continue to be in the spotlight for international organizations that combat fiscal black holes the world over. While the European Union removed the former from its black list of tax havens in May of this year, after urging it to adjust its regulations on collective investment, NGO's such as Oxfam continue to class the territory as “one of the worst tax havens in the world.” An investigation by this organization revealed that in 2012, US multinationals registered profits of €72.3 billion in the Caribbean archipelago. This amount exceeds their combined reported profits in Japan, China, Germany and France.

Following the Panama Papers scandal, Christine Lagarde herself criticized the tax-reduction practices by multinationals. “Large-scale tax evasion [...] typically means lower government revenue, higher public debt, and less investment in health, education, and other public services,” she said at the Financial Action Task Force (FATF) meeting in Valencia, Spain in June 2017.

English version by Melissa Kitson.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.