Average cost of rent in Spain jumps 50% in five years

A new report shows that low-income homes have been hardest hit by the rise, with over 46% of their net income spent on their lease

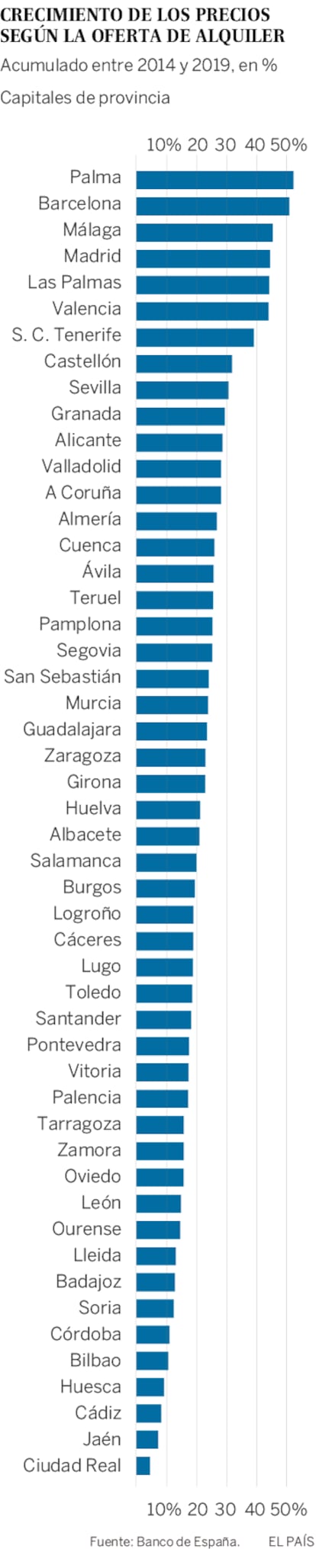

A new report from the Bank of Spain has revealed that the average cost of rent in Spain has risen 50% in the past five years. According to the study, which is based on figures from the real estate website Idealista, rental prices rose the most in Palma and Barcelona (more than 50%), followed by Málaga, Madrid, Las Palmas de Gran Canaria and Valencia (around 45%), between the end of 2013 and May 2019. Areas in inland Spain however, saw the lowest spikes in rental prices.

The report found that the rental prices have increased at a “significantly” faster rate than housing costs.

The rising cost of rent is hitting low-income homes particularly hard. According to the study, families with few resources, who account for the majority of the rental community, are less likely to buy property, given the difficulty of accessing credit. What’s more, they spend a higher percentage of their salary on rent. The report showed that in 2014, the average spending on rental expenses represented 27% of the net income of all Spanish homes, and 46.9% of the net income of low-income homes. In both cases, Spain is above the OECD (Organization for Economic Co-operation and Development) country average.

According to the report, “24.7% of homes had rental costs of more than 40% of their net income in 2014, compared to the OECD average of 13.1%.” Spaniards in the lowest income bracket spend 63.9% of their net earnings on rent, a figure only topped by Greece (68.6%).

The Bank of Spain report indicates that the increasing profitability of rental properties has attracted new players to the market such as investment funds, businesses and real estate investment trusts (known in Spain as socimis). The study, however, says this is not the only possible factor behind the rise in rental prices. Other causes include the precariousness of working conditions, which make it more difficult for Spaniards who are unemployed or in temporary jobs to buy property; the growing number of people moving to the cities in search of work; and the reduced amount of available social housing.

The Bank of Spain study does not reach any strong conclusions on whether the rise in short-term vacation rentals like Airbnb have pushed up the cost of rent in Spain. While the report makes note of the trend, it argues there is no proven correlation.

English version by Melissa Kitson.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.