For sale: two-bedroom apartment, tenant included in the deal

Banks are selling off repossessed homes even when there are still people living inside

Around 36 percent of homes being sold by Catalan lenders to real estate firms and investment funds have a tenant inside, according to sources from the Catalonia regional government.

The properties in question have all been repossessed by banks from borrowers in default, who then cut a deal with the bank: by turning in the keys, the home reverted to the lender, the mortgage was canceled, and the homeowners became tenants instead.

But now, Catalan authorities fear that those families may end up being evicted by the new owners of the properties.

The Catalan Housing Agency fears that these families may undergo a “double eviction”

To stop this from happening, the regional government is considering purchasing a portfolio of homes in partnership with the municipalities where the 774 families affected by the problem have their main residence.

The cascade of home evictions and the loan restrictions triggered by the economic crisis has increased social housing needs. Yet austerity measures have left regional authorities without the resources to properly address the issue.

The Catalan department of land and sustainability affairs has found that banks are selling homes at bargain basement prices, sometimes for prices as low as €6,000, the same sources said.

The Catalan government saw an opportunity there to enlarge its own stock of social housing by exercising its preferential purchasing rights over any bank transactions.

Authorities are looking to buy homes at below-market prices in the 72 locations with the greatest demand.

The regional housing commissioner, Carles Sala, has asked banks for a list of all the properties they are putting up for sale. From now on, the government will have to be apprised of any similar transactions.

Over the last six weeks, lenders have provided details about 2,150 properties that are being taken to market. This list will provide the basis for the Catalan government’s first purchases.

Around 72 percent of buyers of these repossessed homes are businesses, followed by private individuals, who pay higher prices. Business clients include investment funds such as Blackstone, which recently acquired a package of 44,000 mortgage loans from CatalunyaCaixa. Of these, around a thousand had already reached the foreclosure stage by the time the new owner took control.

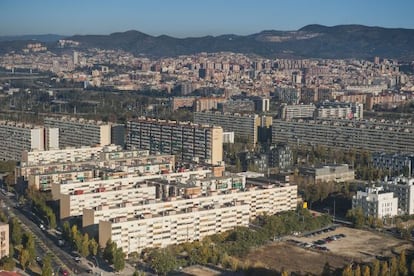

Most of the buyers, however, are anonymous real estate firms taking advantage of the low prices. Some companies have purchased between 10 and 20 apartments in low-income neighborhoods in downtown Barcelona for €14,500 each. Although these vary in location and size (ranging from 40m2 to 70m2), the sale price was identical.

The Catalan government has confirmed that rental management is not what these companies do, leading it to believe that the move represents speculative investment. The new owners are expected to refurbish the homes or hold on to them until the market improves, later reselling them at a higher price.

Rental management is not what these companies do, meaning that the move may represent speculative investment

What authorities are concerned about is that among the 2,150 repossessed homes being sold on the market, 774 of them have tenants living inside.

The Catalan Housing Agency (AVC) fears that these families may undergo a “double eviction”: after losing their property to the bank, they could now be physically kicked out by the new owners. Regional authorities consider these residents to be in a vulnerable situation.

The AVC has sent letters to several mayors informing them of its plans to buy homes for social housing. The agency has put aside €8 million to fund this drive, and hopes that local councils will do the same.

The goal is to expand social housing by 10 percent over the next two years by acquiring apartments for €20,000 to €30,000.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.