Claude, the ChatGPT rival shaking up AI and software: What it is and why it matters

The chatbot, developed by the start-up Anthropic, has been known to companies for years for its focus on practical applications

The chatbot, developed by the start-up Anthropic, has been known to companies for years for its focus on practical applications

Investors welcomed the Greenland agreement with relief, but the attack on JP Morgan raises new concerns. The Trump era is pushing investors to reduce their exposure to the US, a trend expected to continue in the medium and long term

The Morgan Library in New York pays tribute to its first director, who navigated a racist society and went on to lead the cultural institution for over two decades

From the air, underground, or at street-level, EL PAÍS has put together a list of 10 surprising places to explore in the Big Apple, beyond the touristy clichés

The US president also cited former Harvard president Larry Summers and LinkedIn founder Reid Hoffman

JP Morgan, Morgan Stanley, Citigroup, Wells Fargo and Blackrock increased their earnings thanks to the stock market boom and corporate dealmaking

Although the goal is to benefit American workers in advanced sectors, experts warn that the measure limits growth and innovation, especially in artificial intelligence

The precious metal has outperformed stocks and cryptocurrencies so far this year, hitting record highs. In times of uncertainty, its allure draws both major investors and small savers

The erratic trade policy and the worsening fiscal crisis are dragging down economic growth and increasing the risk of a recession

European markets rise nearly 2.5% after sharp declines, while US indices falter following a 104% tariff announcement on the Asian country

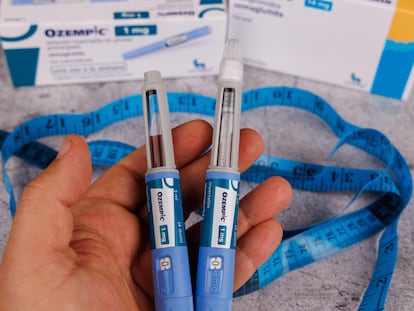

Novo Nordisk, the largest European company by market capitalization, has achieved worse than expected results for its new slimming drug CagriSema

A tour of the devastated areas reveals the destruction that the Eaton and Palisades blazes left in their wake

The surge of investment banking fees and capital gains compensated for the lower margin of traditional business and the increase in costs

JP Morgan Asset Management aims to reach a market share of $1 trillion in exchange-traded funds, which currently manage savings valued at $12 trillion

Concerns have shifted to exposure to commercial real estate credit. The IMF estimates that vulnerable lenders have $5.5 trillion in assets, 23% of the total

The rule would bring the average credit card late fee down from $32. The bureau estimates banks brought in roughly $14 billion in credit card late fees a year

The deal will potentially shake up the payments industry. The U.S. credit card market is dominated by the Visa-Mastercard duopoly with AmEx being a distance third place

JPMorgan, Pimco, BlackRock and State Street withdraw from Climate Action 100+ group following Republican pushback

Consumers held more than $1.05 trillion on their credit cards in the third quarter of 2023, a record

Citigroup announced it was going to cut 20,000 jobs, roughly 10% of its workforce as part of Citi’s restructuring

The bankers are against a number of proposed regulations that could hit their profitability, including new rules from the Federal Reserve that would require big banks to hold additional capital on their balance sheets

JPMorgan, Bank of America, Wells Fargo, Citi and Goldman Sachs earn 20% more in the third quarter of the year

The institutions lost over 20% in revenues compared to the previous year but doubled their figures through June

The Virgin Islands, where Epstein had an estate, sued the company last year, saying its investigation has revealed that the financial services giant was ‘indispensable’ to the financiers trafficking enterprise

With an estimated valuation of $8 billion, the historic German sandal maker is expected to make the leap to the markets with an initial public offering slated for September

Odey AM is on the verge of collapse and the regulator has limited its access to assets and cash due to harassment accusations against founder Crispin Odey

According to the lawsuits, JPMorgan provided Epstein loans and regularly allowed him to withdraw large sums of cash from 1998 through 2013 even though it knew about his sex trafficking practices