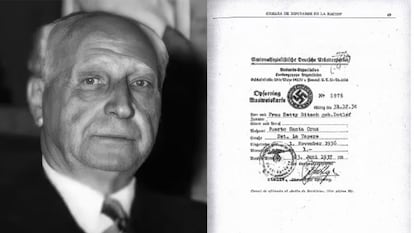

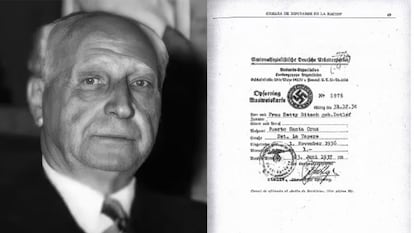

Credit Suisse, on the trail of the ‘Nazi ratlines’ in Argentina

An influential former US prosecutor is investigating the individual and corporate funds that financed the escape of German war criminals

An influential former US prosecutor is investigating the individual and corporate funds that financed the escape of German war criminals

The former manager of Credit Suisse and Millennium has created a multi-strategy firm that has raised $5.3 billion for its launch

In a fragmented planet where populism is advancing, the Joe Biden administration has realized that its power in the markets is proportional to its capacity to impose sanctions

Concerns have shifted to exposure to commercial real estate credit. The IMF estimates that vulnerable lenders have $5.5 trillion in assets, 23% of the total

The Zurich-based bank reported $29 billion in net and pre-tax profit in the second quarter, its first earnings release since the government-orchestrated merger

The rescue packages for Silicon Valley Bank, Signature Bank and First Republic have been marked by a careful balance between state and private intervention

The bank posted net profit of nearly $1.04 billion in the first quarter, down 52% from the same period a year ago despite the new inflows

The agency warns that high inflation and rising interest rates may negatively impact the economy

The country’s parliament is discussing accountability for long-troubled Credit Suisse, state emergency funds for the merger with UBS and what it will mean to have one giant bank

World economic body reduces growth forecast by one tenth of a point to 2.8% due to persisting inflation and recent banking turmoil

At the Swiss bank’s annual shareholders meeting, the UBS chairman said the $3.25 billion takeover would close in the next few months but fully integrating the two institutions is expected to take three to four years

Executives at the annual shareholder meeting Tuesday apologized and insisted the only way forward was a government-engineered takeover by rival UBS

The uncertain future of a union of Switzerland’s two global banks comes at a thorny time for national identity

The public push is part of a larger effort by the Biden administration to safeguard the U.S. economy and ensure that individual bank failures can be contained without triggering a chain reaction across the wider financial system

The Senate Finance Committee on Wednesday released a two-year investigation that detailed the role employees at the embattled Swiss bank had in aiding tax evasion by clients

Experts say it’s probably a good idea for small businesses to diversify funds and make sure they’re in close contact with their banker, but emphasized that in the short term their bank accounts are safe

Cases such as those of Silicon Valley Bank and Credit Suisse show how the sector is facing new risks, such as the speed of fund outflows or the viral spread of bad news and rumors

European Union leaders are playing down the risk of a banking crisis developing from recent global financial turmoil and hitting an already weak economy

The upheaval in the financial system that’s followed the collapse of two major U.S. banks is raising the likelihood that lending standards will become sharply more restrictive

Investors who held bonds known as CoCos were wiped out in the sale to UBS, triggering fears that banks will find it harder to borrow and in turn tighten credit

She added that additional rescue arrangements ‘could be warranted’ if any new failures at smaller institutions pose a risk to financial stability

The bank received a $30 billion rescue package from 11 of the biggest U.S. banks last week in an effort to prevent its collapse

Fears remain that other banks have misjudged the risk to their finances from rising interest rates, as Silicon Valley did

Swiss authorities pushed for UBS to take over its smaller rival after a plan for Credit Suisse failed to reassure investors and the bank’s customers

After sticking to its half-a-point interest rate hike, the ECB has left further rises up in the air in case the banking turmoil persists or deepens. This is exactly the message that the markets needed

Credit Suisse said Thursday that it would exercise an option to borrow up to 50 billion francs ($53.7 billion) from the Swiss National Bank

Credit Suisse has been fighting troubles for years, including losses it took from the 2021 collapse of investment firm Archegos Capital