Spain losing €26bn in tax revenue due to fraud, says economists’ report

The General Council of Economists (CGE) believes underground economy accounts for 16% of GDP

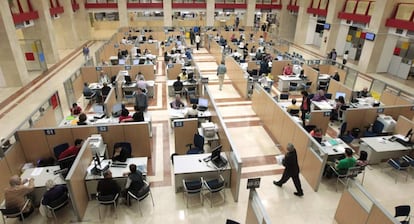

Spain’s General Council of Economists association (CGE) released a report on Thursday in which it estimates that tax fraud in Spain is costing the Spanish economy €25.648 billion a year – that’s 16% of total activity (GDP), which comes in at €168 billion. The report also included 20 proposals to combat the problem, among them improvements to the way the country’s Tax Agency works.

The study, titled “Reflections about tax fraud and 20 proposals to reduce it,” was presented on Thursday by the president of the institution, Valentín Pich, who explained that tax fraud has an effect on intangible factors, such as education, and tangible ones, such as the strength of tax agencies.

The perception that evasion is widespread is one of the reasons that Spaniards commit fraud

The report also explains that the losses in tax income represent 2.5% of the entire Spanish economy, of which nearly 5% corresponds to the evasion of sales tax, or VAT.

Lack of awareness and education, the perception that evasion is common and widespread (with particular focus on the behavior of the country’s politicians) and variations to laws are some of the reasons that see Spaniards commit fraud, the study explains.

The report recommends that the work of tax agencies be improved, including easier ways to correct mistakes in tax returns, adapting the corresponding fine in order to encourage the practice.

The co-author of the study, economist Jesús Quintas, also explained that there is a problem of definition and detection, given that not even the experts can agree on an actual concept of what tax fraud is. They do concur that the underground economy is an “economic concept” and is “hidden,” while tax fraud is a juridical concept and involves the breaking of the relevant laws and is “very difficult to capture through statistics.”

The CGE also recommends trying to reduce the time taken to resolve tax inspections

The CGE also recommends trying to reduce the time taken to resolve tax inspections, to offer special training to new entrepreneurs, to quickly inform businesses about interpretive criteria, and strengthen cooperation between agencies and companies.

It sees a need to set mid- to long-term objectives for tax agencies, to better educate the public on the issue, and to improve the use of digital resources.

The CGE, which works to defend and protect the work of economists, admitted that there are no “magic solutions” for the problem.

English version by Simon Hunter.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.