The International Monetary Fund: ‘Dollarization is not a substitute for a sustainable fiscal policy’

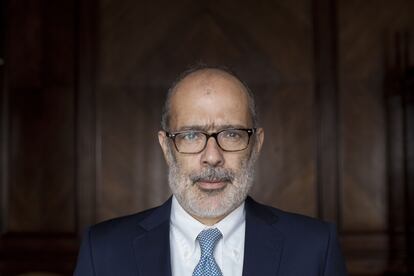

Rodrigo Valdés, the director of the Western Hemisphere division at the International Monetary Fund, warns that the dollarization that ultra-right candidate Javier Milei proposes for Argentina ‘will require seeking a lot of political support’

Latin America is suffering the economic effects of the post-pandemic period, but Chilean Rodrigo Valdés, 56, the economist responsible for the Western Hemisphere Department of the International Monetary Fund (IMF), assures that this slowdown in growth is, to a certain extent, “healthy.” Countries need “a certain deceleration to make the next [phase of] growth sustainable,” he said in this interview with EL PAÍS from his office in Washington.

Valdés is optimistic. He challenges a couple of notions that permeate the region, such as the idea that all extractive industries are bad, and that inequality has worsened. He also addresses the proposal of the leading candidate in Argentina’s upcoming presidential elections, ultra-conservative Javier Milei: dollarizing the indebted country. Valdés warns that such a measure does not replace the need for “a sustainable fiscal policy,” one “that ensures that debts are not too high.”

Question. Is it feasible for Argentina, such a large economy, to dollarize?

Answer. More than the [economy’s] size, the questions that the markets are asking today are about the initial conditions of the amount of reserves that Argentina has. Mr. Milei touched on this issue, and they are still working on a plan, so I don’t want to get ahead of myself in the discussion. It is something that takes time. They have talked about the fact that this would not be done [right away] if they win the election. And it’s also something that will require them to seek out a lot of political support.

Q. The International Monetary Fund recently reached a new agreement with Argentina. What would the implications of dollarization be?

A. Mr. Milei’s program implies dollarization, and that does not [necessarily] mean not having a program [with the IMF]. We have one in Ecuador, which is a dollarized country, and the last one was very successful. For us, it is essential to recognize the way a country organizes its monetary policy, its exchange rate policy, issues that are [matters] of sovereignty. We are interested in the macroeconomic bases being in place so that these systems work in the long term, and [in ensuring that], when there are changes, the transition remains stable.

Q. Would the IMF continue to support Argentina, then?

A. We work with 190 countries and all the institutions that exist within them. What we are interested in is whether they work well, depending on their macroeconomic configurations. How does the labor market work? How does the goods market work? For example, dollarized countries require certain conditions to function well. And it’s very important to us that [it be understood that] what you do in the monetary and exchange-rate worlds are not substitutes for what needs to be done in the fiscal world. This part requires an enormous effort on the countries’ part, and we always understand that the short term and the long term are in tension [with each other]. But there is no substitute for the fiscal part. All countries require a sustainable fiscal policy in which debts are not too high, and dollarizing (or not dollarizing) is not a substitute for that task.

Q. What is the region’s outlook?

A. This year, we’re seeing the consolidation of a significant slowdown from last year’s growth. There are some exceptions. The largest countries, Mexico and Brazil, have been unexpectedly resilient and may grow even more than last year. But, in general, we’re seeing that in many countries this slowdown is healthy because they had a very strong post-Covid performance and required some deceleration to make the next [stage of] growth sustainable. Going forward, there’s still work to be done. There is clearly growth, but we must work on elevating that potential growth.

Q. What can the region do to improve productivity?

A. In order to take charge of this issue, you have to have an orderly macroeconomy, and what many countries have achieved in this regard is important. It is very important to keep these macro policy frameworks working well. Once you have that, where can you invest? We have great opportunities in the world’s energy transition. Many countries in the region have crucial inputs like green hydrogen, for example. Another is the geopolitical shift in which value chains are being set up in countries closer to home. This gives the region a highly significant opportunity for investment. There are regulatory, stability and consistency issues that need to be addressed. It is unnecessary to have risk premiums for investors because our regulatory frameworks are not the most suitable [for this purpose]. In addition, the region has a security and crime issue that, from a macroeconomic point of view, must be treated as more important.

Q. Does insecurity impact productivity?

A. It affects economic growth, people’s quality of life, the desire to invest. It is time for the region to attach even more importance to this issue because it has implications in many areas. The Monetary Fund cannot get involved in this issue and say what to do; we are not experts in this, but we can confirm that it has significant effects, and we can suggest that the authorities look at this as more important than they have so far.

Q. The IMF identifies inequality as a problem that remains to be solved, but is there an example of an emerging market that has achieved that?

A. We have to recognize two things. The first is that our region has made progress, contrary to what is perceived in the public discourse, which is very much influenced by what has happened in the Anglo-Saxon world. The truth is that in the last 20 years income distribution has improved a little; it is still very unequal, but it has improved, unlike what’s happened in the Anglo-Saxon world, where it has worsened. It is certainly not enough, so we have to continue working on it. And the second thing is that if we compare our region with the developed world of OECD countries, we can clearly see that the OECD countries manage to significantly improve income distribution through what they do with monetary transfers. Through many instruments such as unemployment insurance, larger pension systems that provide more money… I believe that the region needs to have more resources to do this, and it must start being more concerned about these transfers as serious insurance against the problems that families sometimes face.

Q. You talk about investments for the energy transition. Is the region trapped in extractive industries?

A. We have to try to remove the positive or negative concept of extracting, because we have known for a long time that countries can be blessed or cursed by their natural resources. Crucially, this depends on how the profits are invested. I would invite those who think that this is an inescapable curse to look at the examples of Australia, New Zealand and Norway, which were rich in natural resources and used those resources to go one step further, for example, by investing in human capital to do other things, and now they are very advanced in the service sector. We should not become pessimistic because we have natural resources. The region would be worse off without them, and what we should be concerned about is using them well.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.