Latin America is a start-up that needs seed capital for conservation

The region’s economic dependence on sectors impacted by climate change is becoming more visible. Still, there are very few companies in Central and South America that have incorporated sustainability into their plans

This year, for the first time, the Earth exceeded seven of the nine planetary boundaries established as a scientific framework to measure the impact of human activities. The Stockholm Resilience Center’s study — published this past September — speaks of a “sick patient” and levels of pollution above what is “safe for humanity.” This situation has been caused by a plethora of environmental problems, including global warming, changes in freshwater systems, as well as the harmful effects of microplastics and toxic chemicals.

The study highlights the urgency of carrying out broad and comprehensive actions in environmental conservation and restoration, especially in regions with high amounts of biodiversity, such as Latin America. However, this will require enormous investments of fresh capital — both public and private — to create and promote sustainability projects. Establishing such projects remains a major challenge.

On the part of corporations, there has been a decline in the channelling of resources towards green projects — such as those related to the energy transition, the circular economy or biome recovery — with more funds going towards updates to production lines or marketing expenses. This is despite the fact that human activities are increasingly evident in the stress cycles being experienced by the planet and the global economy.

The challenge of attracting investment

“There are many conversations and good intentions. But getting investments into [environmentally-sustainable] projects is one of the biggest challenges we have,” laments Rodrigo Wanderley, in an interview with EL PAÍS. He’s a project development partner at Pachama, a technology start-up dedicated to carbon credits. Based in Brazil, the company uses drones and artificial intelligence (AI) to quantify the degradation of forests or jungles and plan conservation action plans in response. “[As we strive to] overcome this challenge, we’re going to have to create quality projects that are sustainable in the long-term,” he adds.

In general, the private sector tends to perceive the issue of climate change as not being urgent. Only a third of managers at 400 large corporations surveyed in Latin America consider that issues related to global warming are a concern for their organization, according to a March study by the consulting firm EY. This is despite the fact that, in 2023, another consulting firm — PwC — estimated that at least 55% of the world’s GDP is exposed to material risks due to moderate or high dependence on nature.

All economic sectors — from agriculture and tourism, to fashion and the pharmaceutical industry — suffer, to a greater or lesser extent, from the effect of the transformation of the planet. And, therefore, everyone would benefit from the investment in the protection and conservation of flora and fauna.

“Things from the point of view of ecosystem regeneration are going slower than we would like,” agrees Santiago Espinosa de los Monteros Harispuru, the co-founder of Toroto, a Mexican company that develops and manages restoration projects, such as those involving carbon sequestration or the preservation of biodiversity.

“We’re not going to have enough resources to face the climate crisis twice… we’re not even going to have enough resources to face it once,” he warns. “To restore and conserve [a large] number of ecosystems, a lot of infrastructure is missing. We need to carefully design and position the [relevant] supply chain. This work isn’t done yet.”

Carbon credits

Pachama and Toroto are strategic partners of MercadoLibre, an Argentine company that operates online marketplaces. They have a sustainability program called Regenerate America. At the end of September, the technology company announced an investment of $2 million dollars in a new project to restore 570 hectares of the Campeche Corridor of the Mayan Jungle, in the Yucatán Peninsula, which is considered the largest tropical forest in Central America. On top of this, Regenera América is developing nine projects in Latin America — seven in Brazil and two in Mexico — at a total cost of about $23 million.

After the announcement to the press, representatives of the three companies sat down with EL PAÍS for an interview in a small room at the Papalote Children’s Museum in Mexico City, where they were also inaugurating an exhibition on recycling.

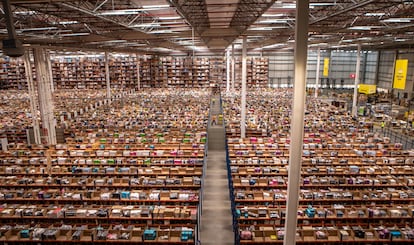

Guadalupe Marín — regional manager of Sustainability at MercadoLibre — recognizes the complexities of the logistics industry, such as its dependence on vehicles that use fossil fuels, the limited supply of biodegradable materials for packaging, or the shortage of electric vehicles to meet the needs of growing online sales. In general, she highlights a latent failure of sustainable innovation, which is essential to the sustainable agenda of companies. “The idea of man being separate from nature is what has brought us to the point where we are,” she notes.

The specialist draws up a roadmap for her peers: “The first thing companies have to do is try to decarbonize and find solutions that allow them to run their businesses at a lower environmental cost, with a lower emissions cost. But we’re in a very pressing situation worldwide and we still lack a lot of innovation.”

“All companies are going to have to resort to [carbon compensation plans] for what cannot be reduced,” she emphasizes. One way to offset pollution is through carbon credit markets. Latin America doesn’t have a mandatory exchange like the European Union, where companies that exceed certain limits on greenhouse gas emissions must offset their carbon footprint through the purchase of these instruments. The money used to purchase carbon credits goes towards the implementation of environmental projects which reduce greenhouse gases.

For example, the restoration of the Campeche Corridor — which links remaining protected areas of the Mayan Forest — will result in carbon being captured and not emitted, through reforestation and the preservation of species. Putting it more simply, the purchase of future carbon credits is equivalent to investing in conservation plans to try to mitigate the effect created by human activity.

“A carbon credit market is a concrete and real path. But we also don’t believe that this is going to be enough, neither for us nor for what the environment needs,” Marín clarifies. “For this reason, this project — which runs parallel to a credit market that [will be set up] in the future — seeks to restore and conserve the biomes, so that they don’t continue to be degraded,” she explains.

Brazil is one of the largest issuers of carbon credits in the world. This is, in part, due to its natural diversity and its Amazon-based wealth. Meanwhile, little by little, Mexico is gaining traction.

While the moment is ripe to create mandatory carbon markets, another initiative stands out — one that can raise resources and relocate them to conservation projects. Green bonds are often confused with carbon credits, but they’re actually debt instruments that offer returns to their holders and represent an additional way to raise money for issuers, which must direct the funds towards sustainability programs.

For example, through the end of 2022, the Mexican bottler and distributor Coca-Cola FEMSA allocated some $664.87 million raised from a bond placed on the international markets in 2020 to “finance or refinance eligible green projects in three main categories: the circular economy, water management and climate action.” The company noted this in a written response to queries from EL PAÍS.

The company has concessions to exploit 28 million cubic meters of water per year for its bottling plants, which sometimes operate in areas that are heavily affected by drought. Faced with the criticism that its activity sometimes causes harm, the beverage giant issued sustainability bonds in the local market for a total amount of 9.4 billion pesos — or the equivalent of $540 million — in 2021. “With the bonds — which are linked to sustainability — we committed to achieving a water use ratio of 1.36 liters per liter of beverage produced by 2024 and 1.26 liters [of water] per liter of beverage produced by 2026. At the end of 2022, the ratio was 1.46 liters… a benchmark in water efficiency in the Coca-Cola system,” the company added.

This trend is gaining momentum. 44% of long-term debt placements in 2022 responded to green bonds being issued by companies, financial institutions and the government, according to the Mexican Stock Exchange. These growing numbers translate — in many cases — into the search for technology that lowers costs and reduces the negative environmental impact of operations.

Kamay Ventures is a corporate venture capital fund that seeks to invest in companies that use innovation to solve industrial bottlenecks, such as facilitating deliveries or reducing water waste. Its main investors are Coca-Cola, the food producer Grupo Arcor and Bimbo Bakeries. The firm is focused on the seed stage — that is, young, small companies with business models that are still in development, which are seeking capital.

Antonio Peña — managing partner at Kamay — explains that, as a general rule, the venture capital fund measures the sustainable impact of all the companies in which they are thinking of investing in, whether these start-ups are focused on technology related to food, finance, or climate. “Basically [these companies] are bringing technology to existing industries from time immemorial, to improve processes and look for new solutions.”

For example, in food, entrepreneurs are exploring how to use AI to find new ingredients that allow for healthier products, as well as how to apply technology to stop the evolution of bacteria, fungi, or even flies. The same goes for logistics, deforestation, or emissions. In their portfolio, Kamay has an Ecuadorian start-up that makes deliveries via emissions-free drones, or an Argentine firm that measures the use of water in agricultural crops to better determine how to maximize use.

“All [venture capital] funds in Latin America are increasingly looking at the [sustainable] impact of solutions. Above all — and especially in our field, which is seed capital — we measure the social awareness behind [the venture] and [pinpoint] where we can optimize, all while taking the climate into account,” Peña explains in a video call.

“I’m an investor, but I was born an entrepreneur. And I can say that, sometimes, the problem between us (venture capital funds) and entrepreneurs is that we’re slower than them. But the resources are coming,” he affirms. “Beyond the declarations of good intentions, there’s a commitment to invest in these kinds of start-ups.”

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.