A European Union of national champions

EU citizens must decide what combination of growth and control they want to deal with the geo-economic remains of the 21st century

EU citizens must decide what combination of growth and control they want to deal with the geo-economic remains of the 21st century

Despite its imperfections, it has proven to be better than the alternative of not having it and has created an area of stability

Monetary policy decisions, like investment decisions, require forecasting the future in conditions of uncertainty

Let us not forget that a world with positive interest rates and inflation is better than a world with zero interest rates and inflation

Now is not the time to change the 2% target, but there is room for improvement to correct the pre-pandemic deflationary bias

The macroeconomic impact of this technology can be significant, accelerating the innovative capacity of society

The EU will not achieve its goals for strategic autonomy and decarbonization, without a budget to support them

The economy’s long-term fundamentals are stronger, forcing the equilibrium interest rate higher

National security now dominates decisions, as the recent programs of investment restrictions, subsidies, and sanctions in the semiconductor sector show

If there are no new shocks, inflation will slow down and central banks will be able to better calibrate their policies

The EU must now defend itself from the external enemy and stop protecting itself from itself; that goes through solidarity investment

Since the European Central Bank began buying public bonds, the fiscal behavior of governments has been responsible

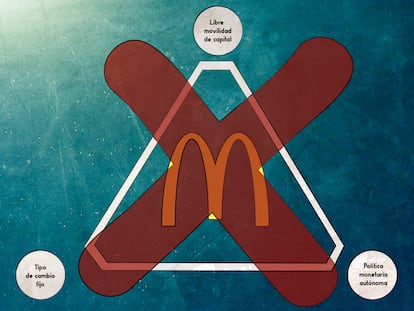

This concept greatly facilitates the lives of governments and central bankers. Unfortunately, it no longer holds

The dilemma facing governments and central banks is complex, and it will require intelligent fiscal support

The process of continuous improvement, as seen in Amazon’s strategy, plays an important role in price fluctuations

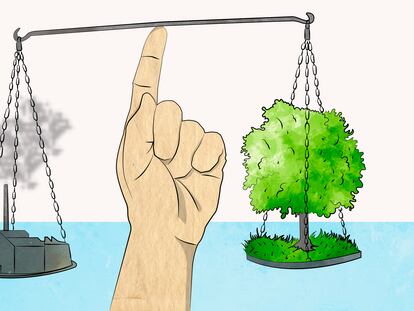

The steep rise in global power costs has raised many questions about how to achieve the goal of renewable, clean and cheap energy

Technological progress is a source of growth and jobs, but we need to be prepared to make the most of it

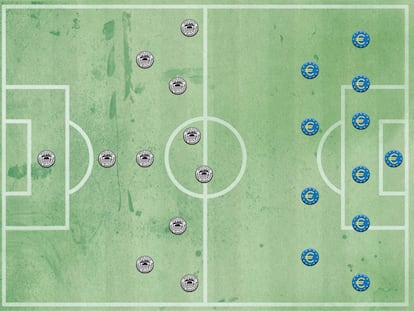

The US Federal Reserve wants the ball and attack; the European Central Bank for now defends, but let’s hope it does whatever it takes to meet its new mandate

The solution to disinflationary pressure is not to erect barriers to limit globalization and disintermediation

The eurozone, unlike the United States, seems content with an incomplete recovery, but this doesn’t have to be the case

A review of the European Central Bank’s strategy faces the stark reality of excessively low inflation

Strict monetary and fiscal rules do not work at times of economic shock or drastic structural changes

Resilience is the fashionable economic objective towards which all the world’s economic powers are converging: growth is no longer the only goal

The single currency is stuck in its international role while the dollar maintains its supremacy

Defining the crisis as an induced economic coma, and not a recession, has allowed for the adoption of a different and sounder strategy

A recovery plan that is as large and generous as necessary needs to be designed, without obsessing over the cost

For now, fiscal policy must continue to prop up activity as much as possible, with the decisive support of monetary policy