The demise of divine coincidence

This concept greatly facilitates the lives of governments and central bankers. Unfortunately, it no longer holds

Originally coined by Olivier Blanchard and Jordi Gali in 2005, the divine coincidence is a property of New Keynesian economic models and implies, simplifying a bit and under a series of assumptions, that stabilizing inflation at the target also implies reaching the optimal level of economic activity. This is the key to most central banks’ price stability mandates: hitting the inflation target is enough to maximize sustainable growth. It is a property that allows the separation of macroeconomic tasks, with monetary policy focused on inflation and fiscal policy on stabilizing public debt.

The problem, of course, is that the necessary conditions for the divine coincidence to hold are not always present. For example, in a situation of chronic insufficiency of demand, such as we have experienced until recently, monetary policy may not be able to bring inflation up to target, and needs the help of fiscal policy. It is also possible that the economy will face a large temporary negative supply shock, as is currently the case. In these cases, it is important to recognize the presence of real wage rigidities: wages adjust less, or at least more slowly, than prices. In such a situation, strict adherence to an inflation stabilization regime that does not allow for some wage adjustment is suboptimal, and generates an excessive reduction in activity: the divine coincidence no longer holds. The solution is to be patient, and create the conditions for a gradual adjustment of wages conditional, of course, on inflation expectations remaining consistent with the target. The current situation is even more difficult, since the volatility of the supply shock – the price increases of all commodities – is much greater than the volatility of demand: for example, the price of a barrel of Brent oil has gone from $80 in January to $128 in March to $109 at the end of April. The reality is that policymakers now have little control over economic variables, and the uncertainty surrounding economic projections is enormous.

Suddenly, energy independence is just as valuable as fiscal discipline

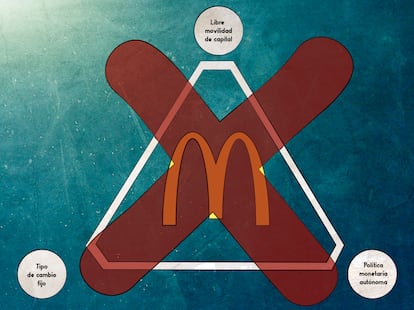

The divine coincidence was defined in the field of economics, but its logic can also be applied to geopolitics. For decades it has been argued that economic interdependence was the best way to ensure global political stability. For example, Thomas Friedman ventured, in 1996, the “golden arches conflict prevention theory”: two countries where McDonalds was established would not enter into armed conflict. Over time, the concept of ensuring world peace through economic interdependence took hold, and one of the best examples has been the German strategy of intense economic relations with Russia: Germany secured a very cheap supply of energy that allowed it to increase the competitiveness of its industry. It was the divine coincidence applied to geoeconomics: globalization made it possible to increase economic efficiency and, at the same time, ensure world peace.

But the reality is that the economic relationships were struck first, and the political implications were rationalized ex-post to justify the economic strategy. After World War II, the US had a surplus of grain, and Russia had a surplus of commodities, and it was in the economic interest of both countries to enter into trade relations. In the same way, China’s opening to international trade generated mutually beneficial economic exchanges for many countries. Pioneering companies lobbied governments, which eventually liberalized trade. The divine geoeconomic coincidence made life easier for governments: the economic relationship interests us, let us praise the political relationship.

Until the divine geopolitical coincidence ceased to hold. The Chinese (or Russian) economic opening did not lead to its democratization, as had been expected. Subtly, frictions between the US, Europe and China increased, and the idea of decoupling the Western economies from the Chinese economy took hold. Hence arose the concept of “producing in China for China, outside of China for the rest of the world.” And the process has been accelerated by the Russian invasion of Ukraine and the ensuing sanctions. The McDonalds theory no longer holds. Suddenly, energy independence is just as valuable as fiscal discipline. Suddenly, globalization has limits – and that is why Germany, so economically dependent on the divine geopolitical coincidence, is so resistant to this new reality that breaks its mercantilist economic model and deteriorates its competitiveness.

The US treasury secretary, Janet Yellen, recently proposed that supply chains be reoriented towards allies – “friend-shoring.” The idea of international trade determined by geostrategic relations and political values is very distant from globalization as a strategy to increase economic efficiency. And, what does “friend-shoring” mean in practice? The countries that abstained in the recent United Nations vote condemning Russia represent more than half of the world’s population. Neither the IMF’s Monetary and Financial Committee nor the G20 were able to agree on a communiqué at their recent meeting, revealing the huge geopolitical gap between the coalition of developed economies and the rest of the world – especially now that tariffs and sanctions are geostrategic tools and dollar reserves can no longer be considered risk-free assets.

The end of divine coincidence, both economic and geopolitical, reduces economic efficiency, introduces extremely high uncertainty, and makes the design of economic policy enormously difficult. The dilemmas faced by policy makers – growth vs. inflation, efficiency vs. resilience – are not going to be resolved in the short term, and they feed into each other. Fortunately, these shocks have come at a time of strong economic growth, underpinned by very robust labor markets: the average unemployment rate of the G7 economies is the lowest in decades.

The divine coincidence will return, once the impact of these supply shocks wears off and a new geopolitical model is built. But the room for error in policy making during the transition period is enormous.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.