Corinna Larsen and businessman Allen Sanginés-Krause co-owned a company in Seychelles

The German consultant, who was once romantically linked with Spain’s emeritus king Juan Carlos I, sent a €30,000 invoice to one of the Mexican’s companies for reasons that are unclear

Corinna Larsen, the German businesswoman who was once involved in a romantic relationship with Spain’s emeritus king Juan Carlos I, once co-owned a company in a tax haven with Mexican entrepreneur Allen Sanginés-Krause. The latter is being investigated by the Spanish Supreme Court prosecutor for making payments to Juan Carlos, which were not declared to the Spanish Tax Agency.

The evidence that reveals this previously unknown connection between Larsen and Sanginés-Krause is among the Pandora Papers, a massive leak of 11.9 documents from 14 offshore service providers. The investigation has been coordinated by the International Consortium of Investigative Journalists (ICIJ), and has counted on the participation of EL PAÍS and television network La Sexta in Spain. The leak covers five decades of documentation, and allows for the reconstruction of operations carried out by politicians, multimillionaires, criminals and elite sports figures in countries and territories that are usually considered to be tax havens due to their confidential approach to sharing fiscal information and the low tax rates offered to foreign capital.

The company in question was named Fortuna Ventures Ltd., and was registered in Seychelles on October 1, 2009. Larsen used her company Apollonio Holdings to create the firm, while Sanginés-Krause used Montpascal Holdings, a company that he was linked to. Documents held by EL PAÍS show that these two firms are shareholders of Fortuna Ventures Ltd., and that Larsen was the director. Neither of the two has responded to requests sent by the consortium about the revelations.

Until yesterday, Seychelles was considered one of the most commonly used tax havens by fraudsters all over the planet. But the European Union on Tuesday took it off its blacklist. Foreign companies registered in the archipelago, which is located in the Indian Ocean, are exempt from paying taxes nor do they need to provide a minimal capital amount to register a company. There is also no requirement to publicly register the name of company directors, according to a law on international commerce that has been in place since 1994.

For many years, Larsen has been working as a consultant and a fixer in international businesses via another of her companies, Apollonia Associates, which is based in the microstate of Monaco in the French Riviera. A Swiss prosecutor, Yves Bertossa, is investigating Larsen for an alleged money laundering offense for having received €64.8 million in a bank account she held in the Bahamas, and that was transferred from a Swiss account held by Juan Carlos I.

Speaking to the prosecutor in 2018, and as revealed by EL PAÍS, she cited the name of Apollonia Associates. She also confirmed that in 2004 she began her consultancy work for Apollonia Associates with jobs for Richemond and Volkswagen “that had nothing to do with Juan Carlos I.”

However, her firm Apollonia Holdings GMBH was not known about until now. The company was created by the Panamanian law firm Alemán, Cordero, Galindo & Lee (Alcogal), which created a steady stream of opaque structures and shell companies in order to hide fortunes from all around the world, according to the Pandora Papers investigation.

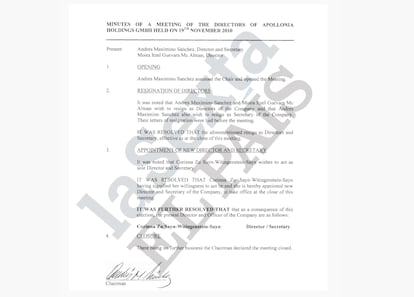

On November 19, 2010, Larsen was named as director and secretary of Apollonia Holdings GMBH, a shell company, replacing Andrés Maximino Sánchez.

On June 2, 2010, Apollonia Holdings GMBH issued a €30,000 invoice for Montpascal Advisory Services, Sanginés’s company, without stating what it was for. The invoice was sent to the address for Montpascal Advisory Services, in Killua Castle, an imposing castle near Clonmellon in Ireland. This property has been visited by the emeritus king.

The public prosecutor at Spain’s Supreme Court has opened three lines of investigation against the emeritus king. One of these is based on a report from Spain’s financial intelligence unit, Sepblac, that warned that Mexican businessman Allen Sanginés-Krause made three bank transfers between 2017 and 2018 to Nicolás Murga Mendoza, a former colonel in the air force and an assistant to Juan Carlos I. Part of these payments were transferred to accounts held by members of the Spanish royal family and other people within their circle, who accessed these amounts via credit cards.

The public prosecutor has taken a statement from the 61-year-old Mexican businessman, as well as from Murga Mendoza. Sanginés claimed that they were “donations” made to the emeritus king, given their friendship.

Juan Carlos I made a voluntary regularization with the Spanish Tax Agency of €678,393 given that the money received from Sanginés-Krause, had not been declared. It emerged on Wednesday that the public prosecutor is planning on shelving all three cases against the emeritus king that were being investigated.

During the years that there was a relationship between Larsen and the then-king, both would regularly spend time with Sanginés-Krause, at parties and other private celebrations, but until now the business links between him and the German consultant were not public knowledge.

Major purchases

Sanginés-Krause, the founder of the investment group BK Partners and a former senior executive at the US bank Goldman Sachs, is little known in his home country of Mexico, despite having made major purchases in the real estate sector such as the Four Seasons hotel. He acquired the luxury hotel complex Mayakoba, in Cancun, and also the Villa Magna hotel in Madrid, where he usually stays when visiting the Spanish capital.

The Pandora Papers have also revealed that in 2007 Larsen was planning for the managers in New Zealand of a trust called Peregrine to make arrangements so that in the case of her death, 30% of the income from the so-called Spanish Saudi Investment Fund would be bequeathed to Juan Carlos I. The fund was backed by the then-king and she had also worked for it. The documents, which were not signed, were created on March 27, 2007, 14 days before the Spanish Saudi Investment Fund was registered in Guernsey, another tax haven. Larsen’s lawyer has stated that these documents are false.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.