Will the Credit Suisse bank takeover calm financial fears?

Fears remain that other banks have misjudged the risk to their finances from rising interest rates, as Silicon Valley did

Fears remain that other banks have misjudged the risk to their finances from rising interest rates, as Silicon Valley did

The fall of SVB has caused multi-billion dollar losses around the world and will weigh on the economy, but experts believe that authorities can contain the damage

The 40 branches of Signature Bank will become Flagstar Bank, starting Monday

Industry experts predict it could become even harder for people of color to secure funding or a financial home supporting their startups

How is the response being paid for? Will Americans end up footing the bill for bank failures? Is this a bailout?

The anxiety this week centered on First Republic Bank in San Francisco, which was once the envy of the banking sector, with its wealthy and well-traveled clientele

The measures requested by the president include clawing back compensation and making it easier to bar failed bank executives from working in the industry

SVB Financial Group, which ran Silicon Valley Bank up until it was seized last Friday, is filing for Chapter 11 bankruptcy protection

After sticking to its half-a-point interest rate hike, the ECB has left further rises up in the air in case the banking turmoil persists or deepens. This is exactly the message that the markets needed

There were few outward signs that Signature Bank was crumbling before the New York Department of Financial Services on Sunday seized the bank’s assets

Nearly half the money went to holding companies for two major banks that failed over the past week, Silicon Valley Bank and Signature Bank

The effort seeks to stop the California-based bank from becoming the third bank to fail in less than a week. Shares of First Republic had fallen sharply this week, dropping 60% on Monday alone

Technology companies in the region will find it harder to get financial services and raise capital after the demise of the niche bank

The CEO of the world’s largest fund management firm thinks it’s too early to tell whether ‘the consequences of easy money and regulatory changes will cascade throughout the US regional banking sector’

The search for causes and culprits for the Silicon Valley Bank failure is refocusing attention on a 2018 federal law that rolled back tough bank regulations put in place after the 2008 financial crisis

Yellen is the first Biden administration official to face lawmakers over the decision to protect uninsured money at two failed regional banks in California and New York

Credit Suisse said Thursday that it would exercise an option to borrow up to 50 billion francs ($53.7 billion) from the Swiss National Bank

Following the Credit Suisse crisis, analysts are divided on whether the central bank will follow through on plans to raise rates by 0.5 points or reduce it to 0.25

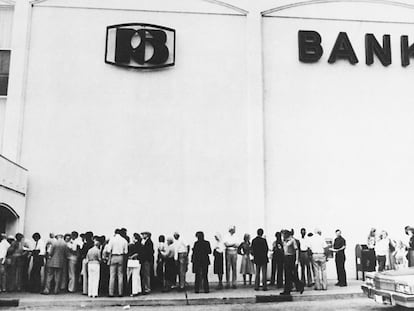

What made the failure of Silicon Valley Bank unique compared to past failures of large banks was how quickly it collapsed

Credit Suisse has been fighting troubles for years, including losses it took from the 2021 collapse of investment firm Archegos Capital

The turmoil prompted an automatic pause in trading of Credit Suisse’s shares on the Swiss market and sent shares of other European banks plunging

Federal Deposit Insurance Corp. officials told Republican senators Monday that they received offers for the bank over the weekend but didn’t have time to close

The 2008 financial crisis unleashed a political realignment that rejected perceived elites and establishment figures

The collapse of Silicon Valley Bank has prompted more calls for slower interest rate hikes, but it is not clear whether authorities should heed them

The recent failures of Silicon Valley Bank and Signature Bank may have you worried about your money

Critics point to many red flags surrounding Silicon Valley Bank, including its rapid growth since the pandemic and its unusually high level of uninsured deposits

The lawsuit says some quarterly and annual financial reports from SVB didn’t fully account for warnings from the Federal Reserve about interest rate hikes