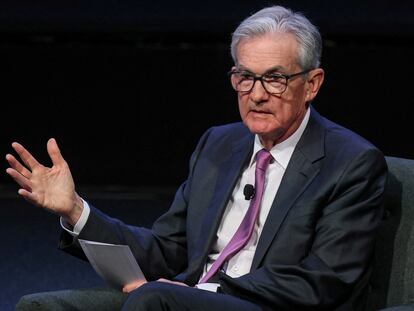

Investors await clues from Powell on Fed’s rate reduction timing

The market is divided on whether there will be a cut at the institution’s first monetary policy meeting of the year on January 30-31

The market is divided on whether there will be a cut at the institution’s first monetary policy meeting of the year on January 30-31

The bank left its benchmark rate unchanged at a record-high 4% and Lagarde said risks for higher inflation ‘include the heightened geopolitical tensions, especially in the Middle East’

Despite sharp interest rate hikes, both are defying the gloomy forecasts of many economic analysts

The unemployment rate was unchanged at 3.7% — the 23rd straight month that joblessness has remained below 4%

The office estimates that inflation will nearly hit the Fed’s 2% target rate in 2024 and that the unemployment will reach 4.4% in the fourth quarter of next year

The cuts suggest the officials think high borrowing rates will still be needed for much of next year to further slow spending and inflation

Chair Jerome Powell will keep the price of money in the United States at the highest level in nearly 23 years

Prices in some areas — services such as rents, restaurants and auto insurance — continued to rise uncomfortably fast

The unemployment rate dropped from 3.9% to 3.7%, not far above a five-decade low of 3.4% in April. Still, the job market is gradually decelerating along the lines that Fed officials have wanted to see

Powell’s remarks follow comments from a raft of Fed officials this week, with most of them signaling that the central bank can afford to keep its key rate steady in the coming months

Despite high interest rates and international conflicts, strong consumption enables the United States to avoid recession

The war in the Middle East spotlights the value of precious metals as safe havens for investors

Milder-than-expected price figures could make it less likely that the Federal Reserve will impose another interest rate hike

The Fed Chair believes the central bank faces nearly equal risks of raising its benchmark rate too high, which could derail the economy, or not raising it high enough, which could allow inflation to persist

Job growth was solid enough to suggest that many companies still want to hire and that the economy remains sturdy

The rates remain at a range of 5.25%-5.5%, the highest in 22 years

Faced with blistering economic growth, the US central bank is expected to keep the price of money stable at the conclusion of its meeting on Wednesday

Compared with a year ago, compensation growth slowed to 4.3% from 4.5% in the second quarter. Still, that is faster than the rate of inflation

Prices rose 0.4% from August to September, a 3,4% increase compared with 12 months earlier. Fed is expected to keep its key short-term interest rate unchanged next week

Besides making it more expensive for U.S. homebuyers to buy a house with a mortgage, higher yields also put downward pressure on prices for everything from stocks to cryptocurrencies

Consumer prices rose 0.4% from August to September, below the previous month’s 0.6% pace

The sustained strength of the labor market makes it likelier that the Federal Reserve will raise its key rate again before year’s end as it continues its drive to tame inflation

The banker says the Silicon Valley Bank crisis is troubling and predicts high interest rates will persist

Inflation expectations are still high despite the squeeze on monetary policy. A target of 3% would be more in line with the economic reality left by the pandemic and climate change, but it is not possible right now

The move to leave its benchmark rate at about 5.4% suggests that the Fed thinks it has time to wait and see if the 11 rate hikes it unleashed starting in March 2022 will continue to cool rising prices

The cooling of inflation suggests that the Fed is edging toward a peak in the series of rate hikes it unleashed in March of last year — action that made borrowing much costlier for consumers and businesses

The latest data raises the likelihood that the Federal Reserve will leave interest rates unchanged when it next meets in late September