US economy expands more than expected in second quarter, boosted by spending

GDP grew at an annualized rate of 2.8%, double that of the first quarter, showing unexpected resilience despite the higher borrowing costs

GDP grew at an annualized rate of 2.8%, double that of the first quarter, showing unexpected resilience despite the higher borrowing costs

The U.S. stock market is at an all-time high, driven by technology shares. Analysts continue to consider equities as being the best investment option for the second-half of the fiscal year

The unemployment rate rose to 4.1%, with discrepancies between the different labor statistics

Prices are soaring and the option to buy is receding for millions of tenants nailed by rising rents

The slowdown is bad news for U.S. President Joe Biden, who is seeking re-election in November. The Commerce Department had previously estimated that the nation’s GDP expanded at a 1.6%

After allies of the ex-president produced a 10-page plan to weaken the central bank, the Council of Economic Advisers issued a statement warning of the dangers of political interference

The economy added 175,000 jobs in a sign that persistently high interest rates may be starting to slow the robust U.S. job market

That possibility did not even exist a couple of weeks ago, but now it is considered a real risk by some analysts. The market is now questioning the central bank’s prediction of three cuts in 2024

Prices outside the volatile food and energy categories rose 0.4% from February to March, the same accelerated pace as in the previous month. From a year earlier, these core prices were up 3.8%

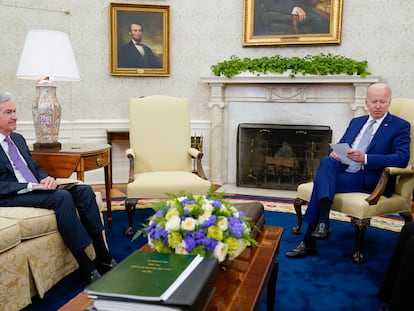

The chair of the American central bank said that he has ‘peace of mind’ because he knows decisions on interest rates are based strictly on economic criteria

The government reported Friday that prices rose 0.3% from January to February, decelerating from a 0.4% increase the previous month in a potentially encouraging trend for President Joe Biden’s re-election bid

The Federal Reserve chair aims to lower the price of money twice before the November elections

The country’s growth and strong job market has done little to diminish widespread unhappiness about inflation and high interest rates

The Federal Reserve is expected to maintain the price of money at 5.25%-5.5% on Wednesday and to update its forecasts for the end of the year

The economist, one of the first to blame part of the recent inflation on corporate profit, is calling on central banks to change their monetary policy

Prices rose 0.4% from January to February, higher than the previous month‘s figure of 0.3%. Compared with a year earlier, consumer prices rose 3.2% last month

Last month’s job growth marked an increase from a revised gain of 229,000 jobs in January. At the same time, the unemployment rate ticked up two-tenths of a point

The rule would require the largest banks — those with more than $100 billion in assets — to hold more funds in reserve to protect against bad loans and other potential losses

Market predictions for an ECB rate cut as soon as April have faded, and expectations among analysts have shifted toward a first trim in June

On the first of his two days of semi-annual testimony to Congress, Powell also suggested that the Fed faces two roughly equal risks: Cutting rates too soon or cutting them ‘too late or too little’

Prices rose 0.3% from December to January, up from 0.1% in the previous month. But in a more encouraging sign, prices were up just 2.4% from a year earlier, the smallest such increase in nearly three years

The former president’s pledge to introduce more tariffs and lower taxes portends more inflation just as the Fed starts considering a cycle of rate cuts

Most participants pointed to risks of lowering interest rates too quickly, according to documents

Expectations for reductions have significantly cooled, but capital markets project the European Central Bank to act first and more aggressively throughout the year

The consumer price index rose 0.3% from December to January, up from a 0.2% increase the previous month. Compared with a year ago, prices are up 3.1%

Democrats demand that Jerome Powell lower rates, while Trump accuses him of wanting to help Biden and says he will not renew his term if he returns to the White House

The unemployment rate stayed at 3.7%, just above a half-century low. Wages rose unexpectedly fast, 4.5% from January 2023