Raids, sanctions and multi-million-dollar fines: China takes economic reprisals amid growing tensions with US

In addition to targeting specific companies, Beijing is considering limiting access to materials and technologies in industries that it dominates, such as intelligent vehicles and the photovoltaic sector

As China takes action against Western interests, the Asian giant’s trade and tech war with the United States has been ratcheted up a notch in recent months. For the moment, Beijing has targeted specific companies, amid growing anger in the globe’s second-largest economy at the pressure Washington is exerting on it. However, the Chinese government, which feels the U.S. administration is trying to undermine the country’s development by imposing blocks and restrictions on trade, is also looking at a broader measure that would limit the West’s access to materials and technologies in key sectors dominated by China, such as intelligent vehicles and the photovoltaic industry.

At the start of April, the Chinese government launched an investigation into the products of the U.S. memory chip manufacturer Micron Technology, a statement by the Cyberspace Administration of China explaining that the probe was in the interests of “national security”. The measure targeted a sector that is at the heart of an intense commercial, military and technological rivalry between the two superpowers. In October, Washington imposed a ban on the export of the most advanced chips to China, with the aim of avoiding Chinese development of state-of-the-art weapons. U.S. allies such as Japan and the Netherlands followed suit.

In February, shortly after Washington had ordered a Chinese high-altitude balloon to be shot down for entering U.S. airspace without permission, Beijing opted to sanction the American defense manufacturers Lockheed Martin Corporation and Raytheon Missiles & Defense for “engaging in the sale of arms to Taiwan [the self-governed island that Beijing views as part of its territory, and which receives military support from Washington].” A week later, the U.S. blacklisted five companies and a research institute from China, for allegedly being linked to Chinese aerospace programs aimed at surveillance.

In March, Chinese measures also hit the white-collar sector. The China offices of U.S. legal firm Mintz were raided, with five Chinese employees detained, while the London-based auditing company Deloitte was fined around $31m for failing to adequately audit a Chinese financial entity. In addition, an executive at the Japanese pharmaceutical group Astella was arrested on allegations of espionage. Panasonic director Tetsuro Homma, the new president of the Japanese Chamber of Commerce and Industry in China, said during a speech in Beijing on Tuesday that the detention has heightened awareness in Japan of the risks of doing business in China, the Japanese news agency Kyodo reported.

With the goal of “safeguarding national security”, Beijing is considering limiting exports of certain crucial technologies in which it is a world leader. On December 30, China’s Ministry of Commerce, together with its Ministry of Science and Technology, and other departments, issued a proposed update to the country’s catalog of technologies subject to export bans and restrictions.

A period for submitting public feedback was then opened — it concluded on January 28 — and the changes are expected to be implemented throughout the year. Published alongside the announcement, the revised catalog includes 139 items, seven of which are new. Among the notable additions to the list is technology for manufacturing photovoltaic silicon wafers, which are used to make solar panels.

The measure, which is the subject of ongoing debate in the Chinese government, could be interpreted as a form of ‘reprisal’ in the short term, and as a safety net to protect the country’s position in the long term, amid the threat of the U.S. decoupling its economy from China’s — and fears that the European Union will do likewise. That’s the verdict of Cosimo Ries, an analyst at the consultancy Trivium China, who specializes in the renewable energies sector in the Asian country.

In Ries’ opinion, Beijing is keenly aware of U.S. efforts to invest in its domestic solar energy industry, with the country’s Inflation Reduction Act apportioning billions of dollars to the development of green energy. In the E.U., meanwhile, the proposed Net-Zero Industry Act aims to see 40% of all products in sectors such as solar and wind energy manufactured within the European bloc. Such moves constitute a “long-term threat to China’s world domination in the solar industry”, Ries says. “Everyone is trying to build their own supply-chain alternative”, so Beijing is out to “put the brakes on those efforts” by making it “much more expensive” for companies to manufacture without Chinese input.

According to Ries, China’s proposed curbs on technology exports are indicative of the fact that the country’s “options for reprisals are actually pretty limited”. Up to now, he adds, Beijing has scarcely taken any action in response to the constant drip of sanctions and restrictions coming out of Washington. “China doesn’t have much to offer in response,” Ries says. “And these are probably some of the only areas in which they can do something.”

Ban on exports of 24 types of technology

If the updates to the catalog are approved, it will be illegal to export 24 types of technology, while there will be restrictions on the remaining 115 (the sale of products will be allowed with a license, but there will be a strict ban on sharing the know-how involved in creating them). The last time the Chinese government updated this list was in August 2020 (and, before that, in 2008).

The ongoing debate over the measure appears to be an intense one, as it is also in the public arena. Bai Chong’en, the dean of the School of Economics and Management at Tsinghua University, has openly complained that including silicon wafers on the list could have a negative impact on the global competitiveness of the Chinese photovoltaic industry. “Since the feedback period was opened, many foreign companies have looked for alternatives to Chinese technology and are looking at the possibility of resuming operations with European and American firms,” the state-owned newspaper Economic Daily says.

According to a report released last year by the International Energy Agency, China is currently home to over 97% of the globe’s production of silicon wafers.

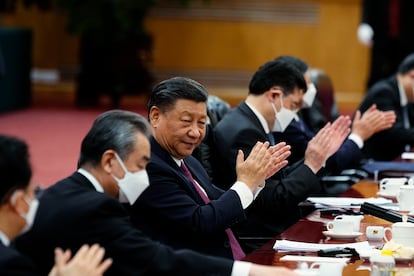

For Beijing, pursuing scientific and technological self-sufficiency is imperative amid the growing tensions with Washington. China’s president, Xi Jinping, called in March for the country to seek “high-quality growth” and to embrace “development guided by innovation”, while the Chinese Communist Party is increasing oversight through a major revamp of state institutions. In clamping down on exports of its top technologies, such as photovoltaic technology, rare earths, intelligent vehicles and biotech, China is protecting its privileged position, by hindering progress in these industries in locations such as the U.S., the EU and India, which is also out to reduce its dependence on the country.

Another major technology that is set for inclusion on China’s restricted and banned list is the LiDAR laser radar system, which is essential to the production of autonomous and intelligent vehicles. At present, Chinese companies have a 58% market share in the sector, according to a study by the Chinese consultancy AlixPartners. Beijing is also considering prohibiting the export of technology necessary for manufacturing high-performance magnets, which are made using rare earths like neodymium and samarium-cobalt. When it comes to rare earths — a group of 17 chemical elements that are present in most everyday electronic devices and are crucial to the manufacture of electric vehicles, wind turbines and sophisticated weapons — China is in a position of complete dominance: it accounts for 85% of worldwide production.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.