Number of Spain’s super-rich increases by 24% since beginning of the recovery

549 taxpayers declared assets of more than €30 million on controversial wealth tax return

The economic recovery in Spain officially began five years ago, but not everyone’s financial situation has improved at the same pace: tax returns show that the rate of recovery has been much faster for the high-income brackets than for others.

The number of super-rich – those whose assets are in excess of €30 million – has grown 23.9% since late 2012, according to 2015 tax figures released this week by the Spanish Tax Agency.

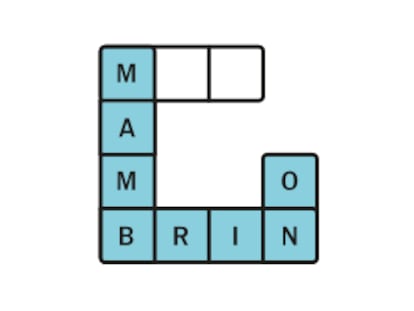

Making matters worse is the fact that each regional government applies wealth tax differently

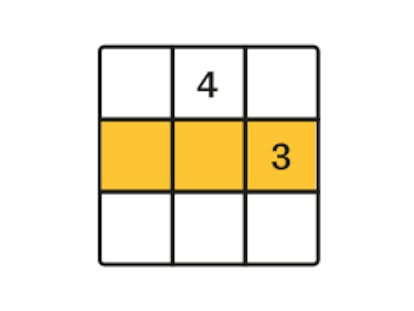

In the last two fiscal years, the number of large fortunes in Spain grew at an annual rate of 8%. Even so, only 549 taxpayers in Spain declared assets worth over €30 million.

But these figures should be taken with a dose of skepticism, due to the pervasiveness of tax fraud and the various mechanisms used by the very wealthy to avoid the taxman.

A total of 188,680 taxpayers filed impuesto del patrimonio, or wealth tax returns, in 2015. As a general rule, people with a taxable wealth of €700,000 and over have the obligation to file this form, which takes into account the value of all assets after deducting mortgages and loans and the value of one’s primary residence (up to a ceiling of €300,000). This typically means that people with gross wealth of more than €1 million have to pay the wealth tax.

The 2015 records show that 57,218 people declared a taxable wealth of over €1.5 million, nearly 10% up on five years earlier.

The combined assets of the millionaires who pay wealth tax are worth €582.6 billion, nearly half the total of Spain’s GDP. Most of this wealth is held in shares, deposits and other financial investment instruments. Real estate is another favored form of holding wealth, representing €102.6 billion.

Spanish wealth tax is a controversial issue. Abolished in 2009 and reintroduced again in 2012, many critics consider that it should be axed because it represents dual taxation. Spain is one of the few European countries to have it.

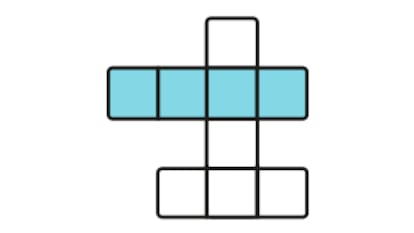

Making matters worse is the fact that each regional government applies it differently, with varying thresholds at which it becomes mandatory to file the form. Catalonia has the strictest rules, which explains why nearly half of all wealth tax forms were filed in that region. At the other end of the spectrum, Madrid has the most lenient wealth tax legislation, with only 16,977 residents filing the impuesto del patrimonio form in the region.

English version by Susana Urra.

More information