Spain’s richest 10% hold more than half the country’s wealth

But the poorest 25% of households have fallen into debt, according to new Bank of Spain report

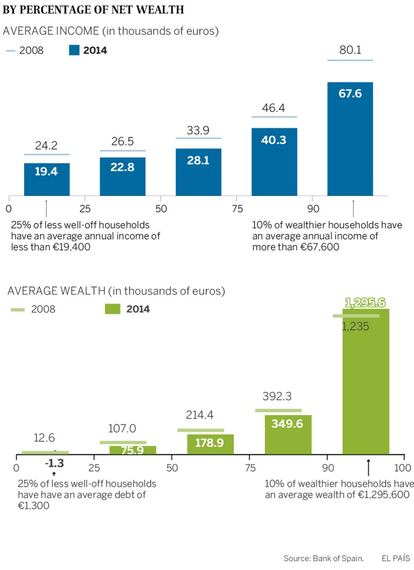

In 2014, the top 10% of Spain’s wealthiest households held 52.8% of the country’s wealth, discounting the national debt. That’s according to the latest Bank of Spain Survey of Household Finances, which was released on Tuesday. The report covers the period between 2011 and 2014, during which time, this percentile saw its net wealth increase: on average, Spain’s wealthiest 10% held average assets with a net value of €1.29 million, compared to 2011’s €1.23 million. But compared to 2008, this group’s wealth had diminished from an average of €1.35 million.

But the Bank of Spain says that the income of the country’s richest 10% does not reflect its accumulated wealth: average household income was €67,000, compared to the figure of €80,300 for 2011.

Meanwhile, the wealthiest 1% in Spain saw its share of national wealth increase significantly: from 16.87% in 2011, to 20.23% in 2014, says the Bank of Spain report.

The reason for this increase is the performance of its financial assets. With more available money, the richest 1% in Spain have been able to invest more in shares and funds. These have performed well once the doubts about the future of the euro were cleared up in 2012. During the period covered by the Bank of Spain report, the blue chip Ibex 35 has risen by 20%.

In contrast, in 2014, on average, Spain’s poorest 25% were in debt to the tune of €1,300. Between 2011 and 2014, the situation of this percentile worsened notably, when its average assets were around €12,600; in 2008, when the crisis kicked in, its assets were €14,800. In short, the Bank of Spain’s data show that the poorest 25% of the population has suffered the biggest loss of wealth over the course of Spain’s ongoing economic crisis.

English version by Nick Lyne.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.