Repsol says seizure is smokescreen to hide Argentina’s problems

Repsol demands eight billion euros for stake in YPF Spain prepares “diplomatic, commercial and industrial” response

Repsol on Tuesday accused the government of Argentinean President Cristina Fernández de Kirchner of seizing control of its YPF unit in order to distract public attention from the Latin American country’s social and economic crisis.

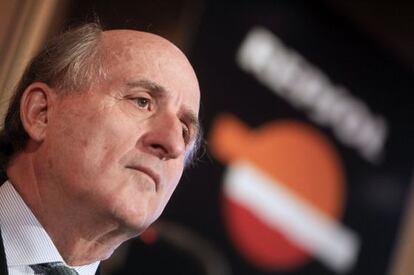

At a news conference, Repsol chairman Antonio Brufau confirmed the leading Spanish oil firm would seek redress with the World Bank’s International Center for Settlement of Investment Disputes. Speaking in Mexico, Prime Minister Mariano Rajoy expressed his “profound discontent” at the move, while his government, which has the backing of the European Union in the dispute, warned of reprisals.

“The Argentinean president yesterday [Monday] carried out an illegal and unjustifiable act after a campaign aimed at pulling down the value of YPF’s shares to pave the way for an expropriation at a sale price,” Brufau said. “By raising the banner of expropriation and in looking for a culprit in YPF, it is seeking to hide the truth.”

Fernández said Monday she had initiated proceedings to take immediate control of YPF by expropriating through a decree a 51-percent stake in the company owned by Repsol. She justified the move on YPF’s dividend policy, which she claims deprives the company of sufficient resources to invest in order to meet the country’s energy needs.

Repsol holds a 57.4-percent stake in YPF.

Fernández said the value of the stake in YPF would be decided by an Argentinean tribunal. Brufau claimed that up until the end of 2011, Fernández, and her predecessor as president, her late husband Néstor Kirchner, had approved of YPF’s strategy.

The decision violates the most basic principles of equal treatment”

Repsol said that YPF, which trades in New York, should be valued at $46.55 per share. At that price, Repsol’s stake in YPF, Argentina’s biggest company, is worth $10.5 billion (about eight billion euros).

“YPF is worth a lot more, but we are going to ask what the law lays down,” Brufau said.

The government also escorted Repsol managers out of YPF’s offices in Buenos Aires on Monday. “They came into our offices under a law approved by \[former president Jorge\] Videla, who was a dictator, even before the president had finished explaining the intervention decree,” Brufau said.

The Argentinean government claims Repsol has recovered its initial investment in YPF, which it fully acquired in 1999 under the privatization program of then-President Carlos Menem.

In a statement, Repsol said that the seizure “clearly contravenes the obligations taken by the Republic of Argentina during the privatization of YPF, breaching the basic principles of legal certainty in [...] the international investment community.”

Brufau said Argentinean law, as well as YPF statutes, obliges the government to launch a full takeover bid for the company after taking a 51-percent stake. The other major shareholder in YPF — Argentinean investment fund the Peterson Group, with 25.4 percent — is not affected by the planned expropriation. Repsol extended a loan of 1.542 billion euros to the Peterson Group to help it acquire its stake at the bidding of the Argentinean government.

By seizing only Repsol’s interest in YPF, Brufau said “the decision violates the most basic principles of equal treatment.” He said Repsol had yet to receive a response from the Peterson Group to the move.

Brufau said the expropriation would not affect the company’s strategy or generation of cash flow. Repsol’s share price closed Tuesday down 6.06 percent.

From Mexico, Prime Minister Mariano Rajoy said: “What happened yesterday [Monday] to a Spanish company sets a very serious precedent in a global economy. I wish to express my profound discontent over the Argentinean government’s decision on YPF.

“It has been expropriated without any reason or justification and breaks the good empathy between Spain and Argentina,” he continued. “It harms Spain, it harms Argentina. It harms Argentina’s international reputation.”

Industry and Energy Minister José Manuel Soria said Spain is considering measures of a “diplomatic, trade, industrial and energy” nature in response. He said he expects these to be announced in the next few days.

While the EU weighs up its options, Brussels suspended a bilateral meeting due to be held with Argentinean officials on April 19 and 20. The United States said it was studying the situation.

“In my opinion Argentina has shot itself in the foot,” Spanish Foreign Minister José Manuel García-Margallo told reporters. “Argentina needs 36 billion euros in funding and it could see itself cut off from credit by international investors after this measure.”

At a presentation of its latest edition of its World Economic Outlook, the IMF said the de-facto nationalization of YPF was bad for the country’s investment climate and economic growth. The IMF expects economic growth for Latin America to slow to 4.2 percent this year from 8.9 percent last year.

Brufau welcomed the support Repsol had received from the Spanish government. “If a government doesn’t make itself respected, it is better not to be a government,” he said.

Mexico, whose state-owned oil company Pemex owns 9.5 percent of Repsol, also criticized Argentina’s intervention. “It seems very regrettable that the Argentinean government of our friend Cristina Fernández should carry out a move that will do no good to anyone,” President Felipe Calderón said.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.