Trump’s Big Lie: This is the simple formula he used to calculate the ‘reciprocal’ tariffs

The Department of Commerce considered neither VAT nor non-tariff barriers, despite claiming to have used a sophisticated system of calculation for each country

Donald Trump’s big lie regarding what he calls “reciprocal” tariffs is his calculation formula. The U.S. president approved a supposedly sophisticated methodology to determine the tariff level to be applied to each country. When it came down to it, however, he completely ignored those procedures and only took into account imports and the trade deficit the United States maintains with each country. Although he presented a formula with Greek symbols as if it were something complex, the reality is much simpler. The trade deficit is divided by imports. That gives a percentage, 39% in the case of the European Union, or 67% in the case of China, which is then divided by two as proof of how “lenient” he has been. Rounding up, 20% for the EU and 34% for China. In other words, a complete deception.

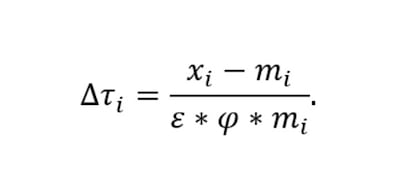

The formula for reciprocal tariffs includes the difference between the value of imports and exports in the numerator — that is, the trade deficit. The denominator seems more complex, but it really isn’t. It shows the imports, multiplied by an assumed elasticity of imports with respect to tariffs and an assumed elasticity with respect to prices. The first elasticity is estimated at 0.25, and the second at 4. Since both are multiplied, the result is 1. Therefore, what remains in the denominator is imports multiplied by 1, that is, just imports.

Thus, to calculate the “reciprocal” tariffs, Trump’s team took this resulting number — the percentage of the trade deficit with a country or group of countries relative to total imports — and divided by two to show “leniency.” For example, according to data from the United States Census Bureau, the trade deficit with the European Union was $235.571 billion, and U.S. imports from the EU were $605.76 billion. Dividing one figure by the other yields a percentage of 38.8%, which, when rounded, equals 39%, which is the figure Trump displayed on his whiteboard as the tariffs the European Union applies to the United States. Nothing could be further from the truth. In turn, dividing 39% by 2 gives 19.5%, which, when rounded up, equals 20%. The same is true for China. The $295 billion deficit is divided by imports of $438 billion, which equals 67.4%, which divided by 2 equals 34%, rounded up again.

Countries with which the United States has a trade surplus or a small deficit have been slapped with the universal basic tariff of 10%, all with the aim of reducing the $1.2 trillion trade deficit the United States ran last year. Reciprocal tariffs have not been applied to Mexico and Canada because they are under the 25% tariff regime (partially implemented) due to the fentanyl emergency and immigration. Under the above formula, Mexico would have been subject to a “reciprocal” tariff of 17%, but the United States has said that it will apply a 12% tariff when it switches to a new regime.

In a call with reporters on Wednesday, senior Trump administration officials implicitly admitted that non-trade barriers were not being measured. "The model is based on the concept that the trade deficit we have with a given country is the sum of all the unfair trade practices, the sum of the cheating," said one administration official on condition of anonymity.

That concept doesn’t hold water. It’s absurd to think that the trade deficit is simply the result of some kind of scam. But it also goes against the methodology Trump approved in an order to launch the process. According to the approved resolution, five elements would be taken into account in a comprehensive manner to calculate the tariffs imposed on each country. First, those that country applies to U.S. products. Second, any “unfair, discriminatory, or extraterritorial taxes imposed by trading partners on U.S. businesses, workers, and consumers, including value-added taxes.” Third, “non-tariff barriers or measures and unfair or harmful acts, policies, or practices, including subsidies and burdensome regulatory requirements for U.S. businesses operating in other countries.” Fourth, exchange rate policies that harm Americans, low labor costs, and other measures that reduce the United States’ competitiveness. And fifth, any other practice deemed unfair.

With all this, almost any tariff was possible, but the Commerce Department hasn’t even attempted to estimate each country’s tariffs and non-tariff barriers. Trump once said he wanted to impose tariffs on the European Union in response to the Value Added Tax (VAT), which Washington baselessly interpreted as a trade barrier. But in the end he hasn’t even bothered to factor VAT into the equation.

Trump, however, lied about this from beginning to end. “In a few moments, I will sign the historic Executive Order instituting reciprocal tariffs on countries around the world. Reciprocal. That means what they do to us, we do to them. Simple. It couldn't be simpler,” he said.

“We’ll calculate the combined rate of all their tariffs, non-monetary barriers, and other forms of deception. And because we’re being very nice […] we’ll charge them about half of what they’re happy to charge us, so the tariffs won’t be full reciprocity. I could have done that, yes, but it would have been hard on many countries,” he said at another point.

“I call this a kind of reciprocity. This isn't reciprocal. This is polite reciprocity. What we're doing is cutting it in half,” he insisted. “My answer is very simple: if they complain, if they want their tariff rate to be zero, then build their product here in the United States,” he concluded.

However, the Commerce Department released its methodology Wednesday night, portraying it as much more complex than it actually was and citing bibliographies. Trump touted a voluminous report on trade barriers, but it was all posturing. “This is like every dumbass academic paper where they make some incredibly stupid claim but cover it up by using Greek symbols,” wrote the statistician Nate Silver in a post on X.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.