The new gray-area dollar in Venezuela is digital

Residents are turning to cryptocurrency to try to beat inflation on the eve of a key political moment

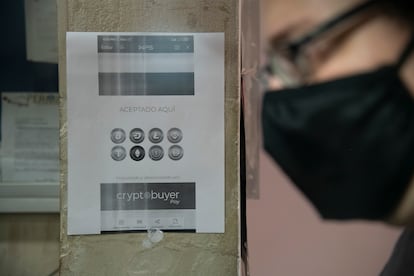

The “we accept crypto” signs once so prevalent in Venezuelan stores, hotels and restaurants have disappeared after another round of scandals involving corruption and imprisonment of key government officials. But that doesn’t mean that cryptocurrency isn’t flourishing in Venezuela — to the contrary. Despite U.S. sanctions, strict oversight by the government apparatus and the ups and downs of inflation, a cryptocurrency exchange network is gaining in popularity among Venezuelans seeking easier ways to make transactions, receive remittances and take refuge from the devaluation of the bolivar.

Vanesa is from Caracas, and like millions of other Venezuelans, she offers her professional services to foreign companies to help them deal with her country’s expensive, dollar-centric economy. She says that this year, the differential between the official dollar (which is fixed by the monetary authority) and its market price has been increasing. Using digital currencies to buy bolivars has become a better option. “If you add it up, between one thing and another, you can save up to $14 for every $100 you exchange for bolivars,” she says. As is customary, she uses a pseudonym to operate on Binance, a global platform of Chinese origin that is very popular in Venezuela. So do sellers, leaving it impossible to know for sure with whom you are trading.

This scenario of digital pseudonyms operating within a gray market — which is not illegal, but also not regulated — is tolerated by Nicolás Maduro’s government because it has become an avenue for scarce foreign currency to enter a country that has been deeply impacted by internationally endorsed allegations of electoral fraud at the July 28 election. The country is now on the brink of another date that is generating political and financial tension: the January 10 presidential inauguration.

“I’ve done work for which they pay me in dollars via a foreign financial app, with that I buy USDT (Tether) and, when I need bolivars, I sell them and receive a deposit to my Venezuelan bank account. It’s easy because you don’t have to use a broker. In the application, you go to see who is buying and selling and, in less than 15 minutes, you make your transaction and you’re done,” says Vanesa.

Unprecedented growth

The massive arrests ordered by Maduro of “currency speculators” who, according to the official narrative, kicked off an economic war, are a thing of the past. During the second quarter of 2024, the market for bitcoins, ether and USDT in Venezuela grew by an impressive 110% compared to same period from the preceding year. That’s more than any other country in the region, according to Chainalysis, a U.S. company that tracks the use of virtual assets using blockchain technologies.

As of December 30, these operations represented an estimated $20 billion that has entered the Venezuelan ecosystem. Considering that private projections suggested that the country’s economy would end 2024 with a GDP of around $100 billion, that’s a significant figure.

Although the country managed to overcome hyperinflation, prices are growing at a slower rate and the growth of its battered economy, which is highly dependent on oil exports, has recovered, Venezuela’s economic situation still has not been resolved. According to data from the Central Bank of Venezuela, monthly inflation in October grew by 4%, lower than the 5.9% during the same month in 2023, but substantially higher than the 0.8% of September of this year, which indicates an upturn. The bank lists an accumulated variation of 16.6% between January and October, although private estimates place the price increase at above 40%.

In addition, the BCV seems to be having increasing difficulties in reducing the gap between the official dollar and the free-floating dollar, through foreign currency injections into the financial system. The price of the euro (which is used by the central bank as a reference for its operations) has increased by 33% in the last quarter, while the bank had sold $5.4 billion to other banks as of mid-December, 27% more than during the same period in 2023.

“The economy is growing, but an economy can grow without necessarily improving quality of life,” says Aarón Olmos, a Venezuelan economist and professor at the Institute of Superior Administration Studies, from his office in Caracas. “There is no wage recovery. Today marks more than 1,008 days without an increase in the minimum wage. The purchasing power of a teacher in Venezuela is 96.6% below the basic food basket,” he says. The monthly minimum wage is equivalent to $3.

The importance of cryptocurrencies

In this scenario, stable cryptocurrencies (or “stablecoins”), which are linked to the price of an asset, commodity or sovereign currency, have become more prominent, because they serve as a digital representation of a good with purchasing power like the U.S. dollar (USDT and USDC) and the euro (EUROC). Between July 2023 and July 2024, 47% of transactions under $10,000 recorded in the country were conducted using these types of cryptocurrencies, according to the Chainalysis survey.

“Stablecoins in particular have become popular because they are pegged to more stable fiat currencies, like the U.S. dollar, and offer a hedge against the volatility of the Venezuelan bolivar […] playing a crucial role in daily transactions and remittances,” says Dan Cartolin, a Chainalysis executive.

International payments through traditional channels, such as banks and remittance companies, tend to be expensive and take several days, so digital options, faster and with lower commissions, are gaining ground throughout the region. According to the World Bank, the cost of sending $200 to Latin America is 6% on average, or a $12 commission.

Such figures are relevant because, according to academic research, half of the Venezuelans who have migrated from their country and send resources back home — mainly, for purchasing food and medical expenses — do so through digital finance platforms, aka fintech. At least 20% of the country’s population has migrated due to the crisis.

“Given current economic challenges in Venezuela, the adoption of stablecoins and other cryptocurrencies is likely to continue and potentially, grow. The use of these digital assets offers Venezuelans a way to preserve their wealth and transact in a more stable currency, which is essential in an environment of uncertainty,” Cartolin says.

Crypto regulator under prolonged audit

And uncertainty is an economic constant in Venezuela. In September, the president extended the restructuring period of the National Superintendency of Crypto Assets and Related Activities for the third time, prolonging an audit that was initially planned to last for six months to a two-year period. The institution was created in response to the Maduro administration’s need to get around international sanctions imposed on high-ranking officials. Though the sanctions have largely been focused on individuals, they have led the global financial system to freeze accounts and blacklist the country.

Tired, and faced with an unprecedented humanitarian and economic crisis, authorities decided to relax their stance in 2019 against the so-called “black dollar,” which despite its dominance in the country’s financial system, was not well perceived due to the way it reduced their control over the balance of payments. Dozens of people were sent to prison, accused of driving up prices that exceeded 30,000% in 2018, and more than 6,000% in 2019.

Officials were forced to take other liberal stances as well, including passing the Anti-Blockade Law that allowed the government to use cryptocurrencies to make and receive international payments and to issue the petro, a centralized stablecoin tied to commodities, namely the wealth of oil reserves. Additionally, an accounting regulation was passed that allowed — and motivated — merchants to sell in bitcoins and other crypto assets and record them in their bookkeeping.

“A situation arose in the country in which a good part of its economy passed through blockchain platforms and bitcoin, USDT and DASH. So much so, that when Sunacrip was audited, the growth of the Venezuelan economy slowed its growth, says Olmos.

Last year, the country was taken by surprise by the suspension of petro and cryptomining operations, as well as exchange activity. This was followed by the imprisonment of the heretofore powerful Minister of Petroleum, Tareck El Aissami, and the leader of Sunacrip, Joselit Ramírez, both on the most wanted list of the U.S. Treasure Department, on charges of drug trafficking and money laundering, respectively. They were being held responsible for the loss of $21 billion from oil sales from the state-owned PDVSA, a part of which should have been located in the crypto coffers.

Authorities gave the order to all apps, both national and international, to freeze transactions in an attempt to collect information, according to a source from the local crypto industry. One executive of a Latin American exchange who was trying to apply for a virtual asset service provider license reported giving up because it was impossible to deal with the abrupt policy changes.

And so today, the signs have been taken down and operations are becoming more discreet. “Everything here is in a gray area. It’s impossible to know if I’m laundering someone’s money, but my money is from my salary,” says Vanesa.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.