Fed expected to announce 10th rate hike before considering a pause

Officials are meeting on Wednesday to make a decision, shortly after the bailout and sale of First Republic, the third bank to go under in two months

The U.S. economic puzzle has increasingly difficult pieces to fit together. The economy has slowed down, but not enough to cool the job market and the rising wages. Inflation has subsided, but it is still far from target and has become entrenched in the services sector. Rate hikes complicate financial stability. The government is about to run out of money if the debt ceiling is not raised, which could have catastrophic consequences, according to Treasury Secretary Janet Yellen.

With one eye on prices and another on banks, Federal Reserve Chairman Jerome Powell is preparing to raise interest rates for the 10th consecutive time before considering a pause, according to analysts and investors.

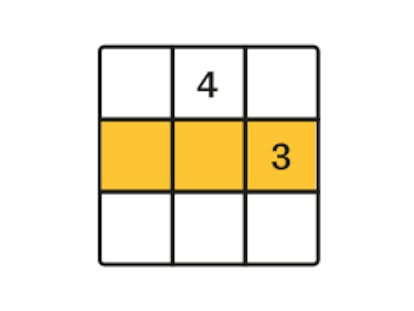

The Fed’s monetary policy committee will conclude its two-day meeting on Wednesday, after which it will announce a policy decision. An increase in interest rates of 25 basis points (0.25 percentage points) is expected, which would raise rates into the range of 5%-5.25%. After this, the European Central Bank (ECB) would foreseeably make a move on Thursday with its own increase in the price of money.

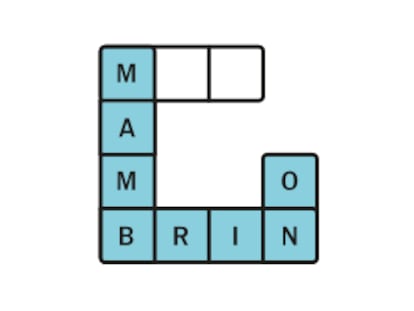

The Fed meeting comes close on the heels of the bailout and sale of First Republic Bank, the third U.S. regional lender to fail in less than two months following the collapse of Silicon Valley Bank and Signature Bank. In this case, the Federal Deposit Insurance Corporation cleaned up the lender’s balance sheet before selling it to JPMorgan Chase, the largest bank in the United States.

The collapse of Silicon Valley Bank in March and the financial storm that it unleashed have complicated the Fed’s attempts to achieve a soft landing for the economy, that is, to control inflation without triggering a recession. At their last meeting, the central bank’s own economists figured that the most probable scenario would be for the world’s first economy to enter a recession at the end of the year.

Some of the problems experienced by lenders are due precisely to the rate hikes, the most aggressive since the 1980s. The rise in the price of money has reduced the value of fixed-income assets and low-interest mortgages on their balance sheets. Banks that managed that risk poorly have suffered from liquidity problems that in some cases proved fatal.

At its previous meeting, the Federal Reserve modified its statement. Earlier, officials had talked about the need for additional successive increases in rates. In the new wording from March 22, the committee anticipated that “some additional policy firming may be appropriate.” The Fed chair said the watchwords were “may” and “some,” versus the “rolling increases” that had been taken for granted.

Although that language seemed to open the door to a pause in rate hikes, the persistence of inflation seems to have prevented it. Powell is aware that financial instability has an additional restrictive monetary effect, but his priority remains to stem the rise in prices.

The market will be very attentive to possible variations in the wording of Wednesday’s statement and, above all, to the explanations that Powell gives at the news conference after the meeting. It is expected that he will leave the door open for a pause in rate hikes, but this cannot be taken for granted since it will depend on how prices and other variables evolve before the next committee meeting, scheduled for June 13 and 14.

“We expect a 25 basis point rise in the benchmark interest rate and, at the same time, that the Federal Reserve will indicate a pause in further rate hikes if the data allows it,” said Tiffany Wilding, an economist at the investment management firm Pimco. The full effect of the fallout from the stresses in the banking sector is uncertain, while inflation and wages remain stubbornly high since the March meeting of the Federal Open Market Committee, she explained. This has led to the committee being more divided about the Fed’s next move than it has been in several quarters. Therefore, said Wilding, the most probable decision will be “a pause that gives time to assess the impact, but is conditional on the new data and maintains an upward trend.”

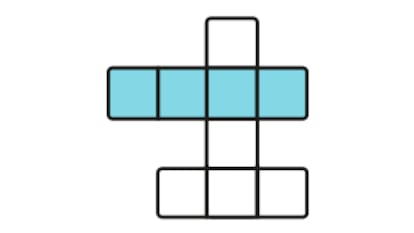

A rate rise on Wednesday would be the 10th in a row, following as many meetings since March 2022. If confirmed, interest rates will have risen 5 percentage points in just over a year from near zero, where they were due to the pandemic. The initial rise of 25 basis points was followed by another one of 50, then four consecutive hikes of 75 basis points, one 50-point hike and two 25-point increases. The last time the Fed raised rates to 5.25% was in June 2006 and kept them at that level until September 2007.

The last time the Federal Reserve raised interest rates so many times in a row was between 2004 and 2006, when the central bank raised the price of money 17 times, although all those increases were 0.25 points. A policy as aggressive as the current one had not been seen since the 1980s, when Fed chairs Alan Greenspan and Ben Bernanke took turns raising rates.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition