OECD tells Spanish banks to shore up capital and limit dividend distribution

New report says country’s lenders are well positioned for this fall’s European stress tests

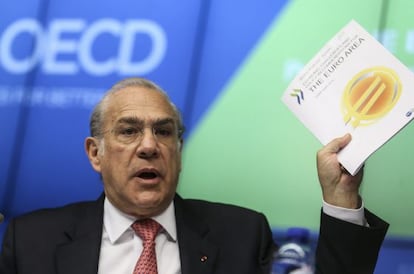

The Organisation for Economic Co-operation and Development (OECD) thinks the Spanish banking sector is well positioned for the European stress tests scheduled for the fall, but sees ongoing weaknesses that need to be addressed.

In a report released on Monday, the OECD contends that “reliance on European Central Bank financing remains high and [Spanish banks] hold an important volume of public debt on their books. Remaining risks are mostly related to the evolution of non-performing loans, in particular in case of a lower than expected recovery both in Spain and the EU.”

The international organization recommends further capital-raising efforts and the placing of a limit on dividends, in line with recommendations issued earlier this year by the International Monetary Fund (IMF).

The recommendations are in line with those issued earlier this year by the IMF

“To ensure that banks remain sufficiently capitalized to support the recovery and avoid excessive reliance on credit reduction to support capital ratios, it will be important to favor supervisory actions to boost banks’ capital,” reads the Economic Survey of Spain. “Thus, the recommendation to limit dividend distribution should be reinforced and extended beyond 2014.”

The Bank of Spain has confirmed the trend: Spanish banks’ profitability measured as profits over total assets fell from 1.11% in 2007 to 0.31% in December 2013.

As for the sector’s efforts to date, the OECD report notes that “the banking system capital and liquidity positions have strengthened and market funding costs have also decreased” ever since the Spanish government launched a reform program that included merging weaker banks and transferring real estate assets from banks’ balance sheets to a “bad bank” called the Sareb, which is 45% owned by the government.

“In 2014 the Sareb is expected to increase sales but profitability will depend heavily on house price dynamics,” reads the report. The National Statistics Institute on Monday released figures showing a rise in house prices for the first time since the onset of the crisis in 2008.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.