Wall Street impressed by strength of Mexican peso despite a weak economy

Market analysts and strategists differ in their forecasts for the currency, which has performed surprisingly well in the last two years

To Wall Street’s surprise, the Mexican peso is performing better than any other emerging economy’s currency. Mexico has experienced disappointing growth since 2019, has not fully recovered the economic activity it lost during the pandemic, and its future prospects are not particularly bright. However, the appreciation of Mexico’s currency stands out among other emerging market currencies. In this context, experts and market traders disagree about the currency’s future.

This week, economists from the Bank of America (BofA) investment bank published a report announcing that the “super-peso”—which they estimate has appreciated against the dollar by 17.5% since April 2020—will remain strong. “The result is surprising to the extent that Mexico’s growth has been weak and political uncertainty remains high,” wrote economists Carlos Capistrán, Christian González, and Claudio Irigoyen. The report emphasized that, in the second half of 2021, Mexico barely escaped a technical recession, and the economy is now stagnant. In addition, the initiatives that President López Obrador has sent to Congress to limit private investment have created uncertainty, the economists added.

However, analysts agree that a decision by López Obrador’s government is one factor that is contributing to the strengthening of the Mexican peso today. Unlike countries that implemented extensive welfare programs, Mexico’s president resisted the pressure and refused to increase spending to contain debt. “A tight primary balance has helped Mexico keep public sector debt below 50% of GDP,” BofA wrote. “Investors in fixed-income markets like a tight fiscal stance. It has also kept rating agencies at bay,” the analysts added.

Rodolfo Navarrete, the director of investment analysis and strategy at the brokerage firm Vector Casa de Bolsa, agrees with this analysis: “Many economists were demanding that the government increase spending on Covid, which the government did not do; it is likely that the move worked out well. It is also likely that, because the Mexican government didn’t support such a policy during the pandemic, the economy fell more than it should have, but that is not totally clear”

Monetary policy has also boosted the currency. Since the middle of last year, the Bank of Mexico has consistently increased its reference interest rate to deal with inflation, which stems from the pandemic and economic stimuli in developed countries. Mexico’s interest rate went from 4% in March of last year to its current rate of 7%.

When it comes to betting on the peso’s future, Wall Street is more divided. Navarrete maintains that the peso will remain close to its current level, below 20 pesos per dollar, for the rest of the year. BofA expects a slight depreciation to 21 pesos per dollar by the end of this year and then to 22 pesos per dollar in 2023. Luciano Rostagno, a market strategist at Mizuho bank in Brazil, also believes that the peso will reach 21 [pesos per dollar] this year. He argues that the current price does not reflect the country’s weak economic outlook.

“My model suggests that the Mexican peso is overvalued by 13% relative to other emerging market currencies,” said Rostagno by phone from São Paulo. “I do not expect the peso to appreciate beyond what it is now for two reasons. First, the new cycle of interest rate hikes by the Federal Reserve in the United States will take a bit of the shine off the peso. Second, the Mexican economy will not grow much this year because the government continues to implement a tight, low-spending fiscal policy.”

Rostagno explains that the same strategy of fiscal austerity that is driving the currency today could end up limiting the peso’s appreciation, if it turns out that the economy is not growing because the Mexican government is not spending.

The “super-peso”

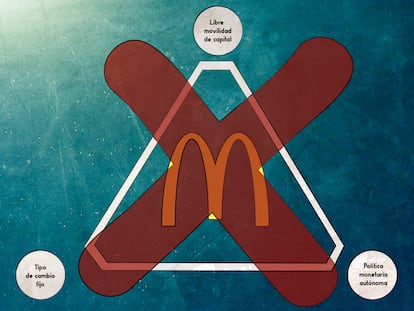

The Mexican peso is a currency like few others. Its high liquidity in the global financial markets—and the fact that it is traded 24 hours a day, five days a week—makes it a favorite of traders when they want to invest in emerging markets. This means that when things go wrong in the market, the peso tends to depreciate more than its peers, and, conversely, when things go well, they go better for the Mexican peso.

For that reason, when the Mexican peso resists strong pressure and remains stable, analysts use the expression “super-peso.” “Basically, they apply it to the fact that the peso is withstanding everything,” says Navarrete. “Many things are happening in the world: the war in Ukraine, the inflation crisis, problems [Covid-19 outbreaks] in China, etc., and the peso is remaining stable. It is not acting as volatile as other currencies,” he adds.

Tu suscripción se está usando en otro dispositivo

¿Quieres añadir otro usuario a tu suscripción?

Si continúas leyendo en este dispositivo, no se podrá leer en el otro.

FlechaTu suscripción se está usando en otro dispositivo y solo puedes acceder a EL PAÍS desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripción a la modalidad Premium, así podrás añadir otro usuario. Cada uno accederá con su propia cuenta de email, lo que os permitirá personalizar vuestra experiencia en EL PAÍS.

¿Tienes una suscripción de empresa? Accede aquí para contratar más cuentas.

En el caso de no saber quién está usando tu cuenta, te recomendamos cambiar tu contraseña aquí.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrará en tu dispositivo y en el de la otra persona que está usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aquí los términos y condiciones de la suscripción digital.

More information

Últimas noticias

Welcome to the post-religion era: The idea of Christianity as the absolute truth has become obsolete

‘I thought you would like it’: The risky sexual practice popularized by TV shows and TikTok

The digitalization of tourism: ‘They promise experiences and gave us the worst possible one’

Mexican peso defies uncertainty with forecasts of a new period of stability in 2026

Most viewed

- Sinaloa Cartel war is taking its toll on Los Chapitos

- Reinhard Genzel, Nobel laureate in physics: ‘One-minute videos will never give you the truth’

- Oona Chaplin: ‘I told James Cameron that I was living in a treehouse and starting a permaculture project with a friend’

- Why the price of coffee has skyrocketed: from Brazilian plantations to specialty coffee houses

- Silver prices are going crazy: This is what’s fueling the rally