From Panama to Puerto Banús: How the rich use offshore companies to buy homes in Spain

The massive leak of documents known as the Pandora Papers shows the key role of tax havens for the wealthy when making property transactions in areas such as the Costa del Sol or Madrid

Two enormous palm trees welcome visitors to Villa Hermes, a mansion on a 3,000 square-meter plot of land built in 1981 in the Nueva Andalucía residential area, just north of Marbella’s upscale Puerto Banús. In this district, in the south of Spain, anonymity and luxury go hand in hand. The plot is surrounded by a towering, spotless white wall, with dozens of security cameras keeping watch. A search on a real estate website will tell you that the average cost of a property in this area is around €2 million, although prices can be as high as €5 million. In between the houses are the holes from four different golf courses.

The secrecy of this mansion reflects the secrecy of the firm that runs it – a company in Malta in the name of an office of local lawyers. If you follow the trail of anyone who has the ability to maneuver their way through business registries, it ends in this Mediterranean island, a tax inspector confirms to EL PAÍS. The information on the network of companies used to hide the real owners of Villa Hermes is locked away in the desks of lawyers and offshore service providers in tax havens.

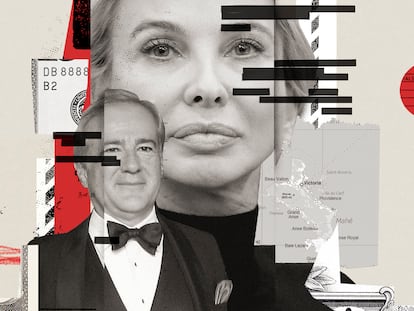

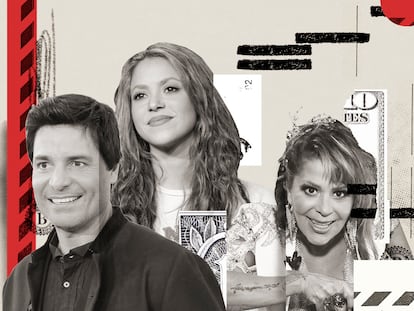

The 11.9 million documents leaked in the Pandora Papers, a collaborative investigation coordinated by the International Consortium of Investigative Journalists (ICIJ), include the names of more than 1,600 fiscally opaque firms that have been used to hide property transactions and the true owners of mansions, many of whom are based in London. With these documents, you can follow this and other trails that lead from the most important banker in Colombia, Jaime Gilinski, to his luxury apartment in Madrid, and from large investment funds to multimillion-euro real estate transactions in Barcelona.

Hiding the owners of a home behind companies created in opaque jurisdictions is legal. In some places, it’s even normal. But the appearance of these firms in money laundering cases and the impact this could have on the property market has put the practice under greater scrutiny.

A widespread practice

The owner of Villa Hermes is the Maltese firm Anahita & Artimisa, as seen in the internal files of Fidelity Corporate Services, one of the 14 offshore service providers at the center of the Pandora Papers data leak. This company belongs to a firm called JB Commodities BV, located in the British Virgin Islands, which is a tax haven. The owner of JB Commodities BV – who is not mentioned in the business registry – is businessman Mehran Muslimi, who explains to EL PAÍS that he is “active in the blockchain and fintech field.” Muslimi lives in Dubai and created the firm, he says, on the advice of a Spanish lawyer.

The practice of buying homes via a company based in a tax haven is not illegal, but all experts who spoke to EL PAÍS – in Spain and in other countries – agree with what Benjamí Anglès Juanpere, professor of financial and tax law at the Open University of Catalonia (UOC), explains by email: “It is often used by people who want to avoid paying taxes and for money laundering.”

In Spain, the Costa del Sol in Málaga province has for years been the target of foreign investment channeled through companies in tax havens. In the leaked documents of the offshore service providers at the center of the Pandora Papers investigation, there are dozens of examples. In April 2015, the Egyptian businessman Mansour Amer bought a home in Puerto Banús. Amer is the head of a self-named real estate group and is the architect of half a dozen vacation complexes along the Mediterranean coast in Africa and the Black Sea. To make the purchase, he used a Panamanian company called Rema Spain SA, which did not buy the property itself, but rather all the shares in the Spanish company Real Estate de Comunicaciones SLU. The only goal of this transaction was to make Amer the owner of the home in the apartment complex Laguna de Puerto Banús, which was sold to the Panamanian company for €4.4 million. However, in the property registry, Real Estate de Comunicaciones SLU continues to appear as the owner.

What doesn’t appear in the property register is who controls Real Estate, and therefore, the home. This kind of practice has been seen for years, says José María Mollinedo, the secretary general of Gestha, a union representing Finance Ministry workers. “Homes change hands without the Tax Agency observing that there has been a property transfer,” he explains. Companies are usually opened in Gibraltar, a British Overseas Territory in the south of the Iberian peninsula, or in other fiscally opaque places. “In no property registry, does the change in ownership appear, it continues to be in the name of the offshore firm.”

From Lagasca street in Madrid to Barcelona’s Diagonal avenue

In the past few years, the buoyant real estate market in luxury areas has made Madrid an attractive city for foreign investors. Many have opted to purchase a property through a company, as was the notorious case of Venezuelan buyers linked to the regime of former president Hugo Chávez. There are considerable tax advantages of buying via an offshore firm. “In addition to not being subject to the accounting and registration requirements of Spanish businesses, it is not subject to corporate tax, nor does VAT [sales tax] have to be paid in the case that a newly constructed property is bought nor the tax on asset transfers if it is a second-hand home,” says Anglès Juanpere, a professor of financial and tax law at the UOC. “The wealth tax that it accrues every year would also not have to be paid. It would only be subject to the annual municipal property tax.”

One of the most selective buyers of the upmarket Madrid neighborhood of Salamanca is Jaime Gilinski, the second-richest man in Colombia. With a fortune of more than €3.4 billion, according to Forbes magazine, Gilinsky is the owner of the largest bank in Latin America, GNB Sudameris. In December 2018, the banker used a Panama-based company called Colden Investments SA to sign a sales contract for an apartment on Lagasca street 99, one of the most exclusive residential blocks in Madrid. According to the developers, his 650-square meter lobby is the largest in the Spanish capital. The link between Gilinski and the Panamanian company does not appear in the public registry, but rather in the internal documents of Alemán, Cordero, Galindo & Lee (Alcogal), one of the law firms at the center of the Pandora Papers investigation.

It is common for large real estate companies to have links to tax havens. Many of the funds that invest in Madrid and Barcelona manage their assets from opaque jurisdictions – an issue that has been denounced by neighborhood associations in both cities. Among the leaked documents in the Pandora Papers is the 2017 yearly report of Patron Capital, which manages €4 billion of assets across Europe. This report shows in detail the structures that are used to make investments. “BCN2″ is the name of a 2005 project for the purchase of 244 rental properties, 700 parking spaces and more than 30,000 square meters of office space. Patron Capital bought 37% of the complex, for €207 million, from the property development arm of Spanish bank La Caixa. This was despite the protests of the tenants of the apartments, who presented an offer of €180 million. According to the developer, this offer “did not meet the conditions nor offered guarantees.” The entire operation was controlled and managed by a company in the British Virgin Islands, a shareholder in the English web of Patron Capital, which is itself a shareholder of a firm in Luxembourg. A spokesperson from Patron Capital explains: “Like in most cases in the venture capital and investment fund industry, our funds are domiciled in different jurisdictions. We and the companies we invest in pay taxes according to the rules of each jurisdiction and comply with the applicable law.”

Consequences for Europe

It is not easy to measure the consequences of these types of investments, precisely because of the secrecy of the companies created to avoid taxes. It is estimated that just in Europe, governments lose €46 billion in taxes a year due to the use of tax havens.

The problem is the legality of these structures. Christopher Trautvetter, a tax expert who has advised large companies and the European Parliament, explains: “Of course it is not illegal to remain anonymous, according to the law of the British Virgin Islands. That’s why service providers have an interest in keeping the laws as they are.”

The impact these practices are having on the property market can be seen in cities where the issue is being studied. This is the case in London, the only city where any company located in a tax haven that owns property has to be included in a publicly accessible registry. Several studies have detected a rise in the cost of homes and a distortion of real estate activity toward the luxury market, which is leaving properties underused or in disuse. This is a problem in a city where more than 36,000 homes are owned by a company from a different country. A study by the organization Transparency International found that “75% of UK properties that are currently being investigated because of corruption are registered in secret safe havens.” It’s a similar situation to what happened during the real estate boom in the Brazilian city of São Paulo, according to a different study by Transparency International.